Shock to the System: Payrolls Blowout Raises Questions About the Fed’s Next Move

Is the Fed done cutting rates already?

Stocks initially rallied in response to the well above expectations NFP print of 254,000 new jobs created and for the first time in months upward revisions of the prior two months’ worth of weaker than expected data.

The upshot was a rally in stocks, which as the morning has progressed is showing signs of wear and tear, along with a rather inopportune jump in U.S. Treasury bond yields with the U.S. Ten Year Note breaking above the important 3.9% yield area, which puts 4% in play. The repercussions of this sudden rise in bond yields clearly suggests that the bond market is now expecting a resurgence in inflation just as the Fed is beginning a rate cut cycle.

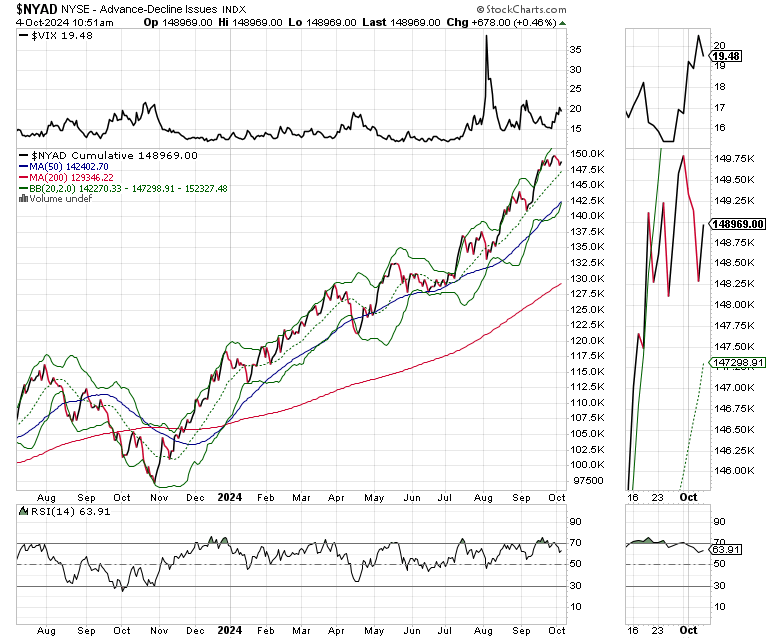

And while the indexes initially moved moderately higher, the most accurate indicator of the market’s trend, the New York Stock Exchange Advance Decline line (NYAD), as of this writing, was much more muted. It has not made a new high in response to the robust employment number.

Putting it all together, especially as the election nears and geopolitical tensions in the Middle East rise, it’s a good time to be cautious.

Housing Update

Yesterday, in this space, I noted that mortgage rates might have bottomed and that those homebuyers who locked in their rates within the last two weeks, were likely the smart money. It looks as if that perception might have been correct, given the jump in bond yields and the likely jump in mortgage rates which will follow.

The iShares U.S. Home Construction ETF (ITB) did not like the action in the bond market. It is now testing its 20-day moving average. Indeed, the next few days will likely be crucial for the homebuilder stocks.

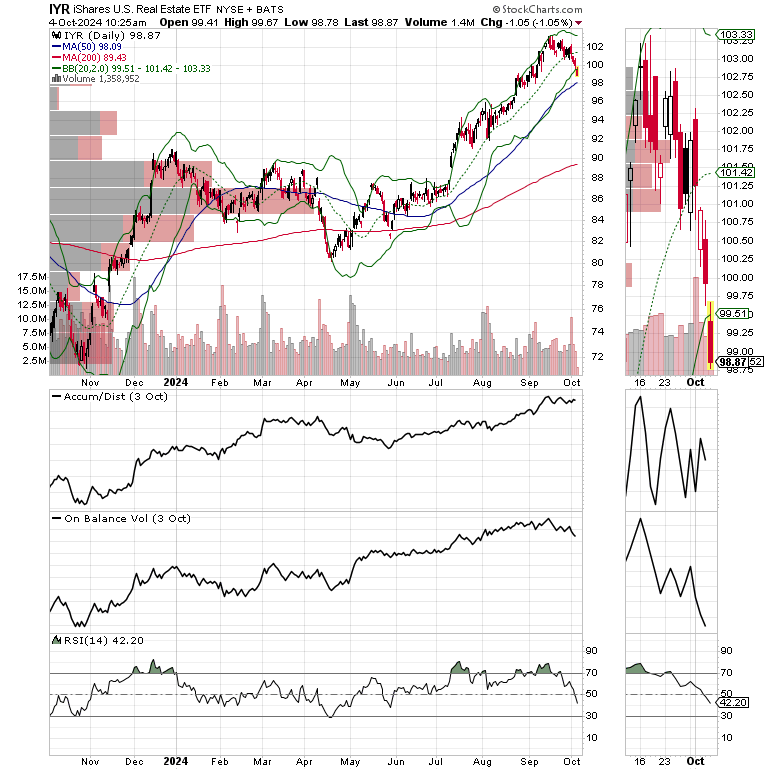

The iShares U.S. Real Estate ETF is now testing its 50-day moving average, another sign that the markets are not expecting bond yields to ease anytime soon.

The Fed’s Next Move

Mr. Powell recently noted that the Fed will slow its rate cutting pace to perhaps two 25 basis point cuts by the end of the year. Yet, the Fed’s focus is now the labor market, which seems to have self-corrected after two months of weakening data.

All of which means that the next hot topic in the markets will be whether the Fed backs off altogether from any further rate cuts for fear of rekindling inflation.

I will have more on all of these topics in Sunday’s Smart Money Trading Strategy Weekly. If you’re not a subscriber, this would be a good chance to join the club.

In this issue, I am updating all the sell stops in the currently open trades in both the Momentum and Extended Stay Portfolios as we wait for further developments.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.