Patience is Paying Off as Open Trades Gather Steam. Plus, a New Monday Trade.

When in doubt, just follow the money.

Over the past few weeks, as the markets have been fretting about things which are beyond their control, I’ve been slowly building positions in stocks where money flows have been stealthily rising. Those trades, especially in the tech sector in companies beyond NVDIA (NVDA) are starting to pay off.

Today, I’m adding a new technology stock which is being quietly accumulated and which has the potential to deliver a well above average short term trading profit.

In my most recent Smart Money Trading and Strategy Weekly, I summarize my current trading posture and rationale. You can check it out here.

Now, let’s have a look at the early Monday morning markets, as they await political developments in Washington and elsewhere, two days of Fed Chairman Powell’s congressional testimony, and the June CPI numbers, out on Thursday.

Market Update

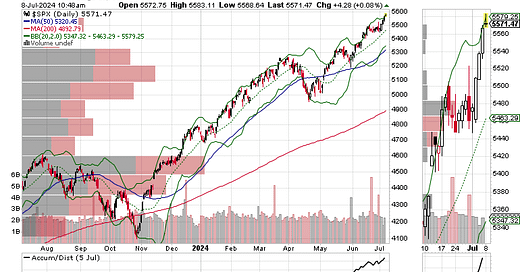

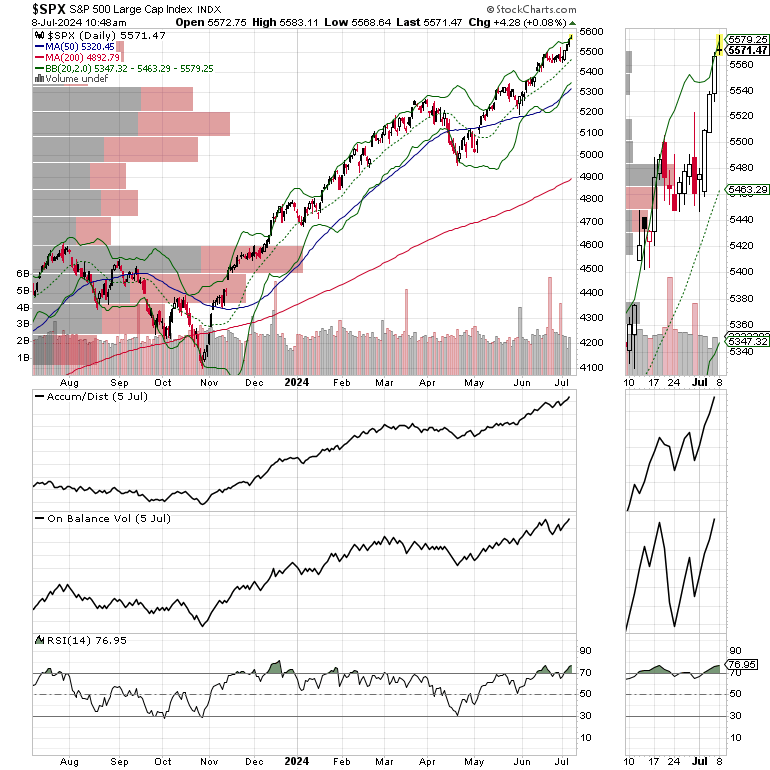

The S&P 500 (SPX) continues to make new highs. More important, the New York Stock Exchange Advance Decline line (NYAD) is now within reach of confirming the new highs on SPX.

SPX is overbought, but both ADI and OBV are rising, which means there is still upside momentum building. More reassuring is the action in NYAD.

The trend in the NYAD is important because the major indexes are often distorted by heavily weighted stocks such as NVDIA while in the NYAD, all stocks count the same. From a practical sense, a bullish trend in NYAD means that the odds of picking winning stocks rises.

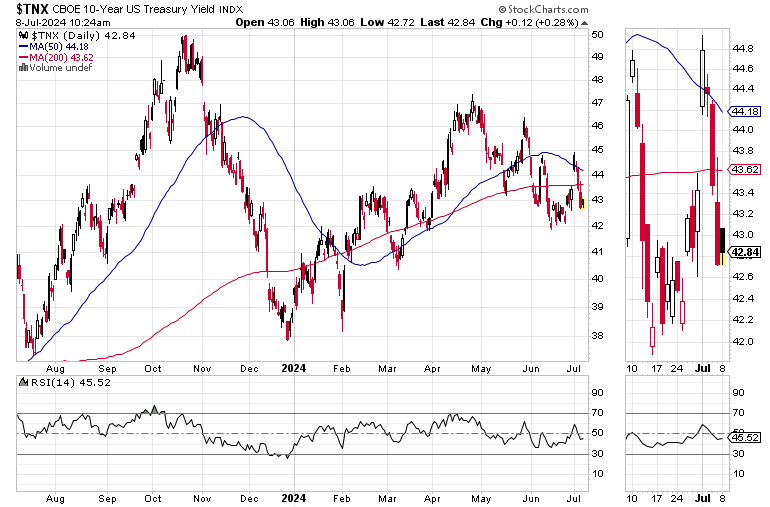

Meanwhile, the U.S. Ten Year Note yield is back below its 200-day moving average, which is a bullish development for stocks.

Thanks to everyone for your ongoing support. I really appreciate it. If you’re a FREE subscriber, this is a great opportunity to grab that FREE preview or upgrade to Paid status.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.