New Trade Monday - Cenovus Energy Delivers a $165% Annualized Gain

Let’s Give this Market Some Time Before Making Big Bets

The good news is that the recent decline in stocks may be taking a breather as calmer heads are prevailing in the Middle East; at least for now. The bad news is that bond yields continue to creep higher, although this may be running its course as well. This confluence of developments is making the market difficult to trade in the short term.

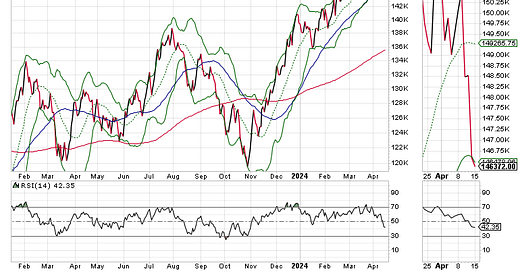

The New York Stock Exchange Advance Decline line (NYAD) started the day with a bounce. But as the day has progressed it has reversed and is now testing its 50-day moving average. That’s because the U.S. Ten Year Note yield (TNX) has crossed above 4.6%, and may be moving higher. The key resistance level now is the 4.7-4.8% range.

The most encouraging sign on NYAD is that it’s approaching an oversold level on the RSI, which suggests the correction may be nearing its final stages, barring an unforeseen event developing.

Also encouraging is the fact that TNX is trading above its upper Bollinger Band. That suggests that a reversal is coming at some point.

Still, I am being cautious and I don’t have a new trade for now. If things change, I will have an update with a new trade before the end of the week as conditions warrant.

I have three open trades which are well within their BUY ranges and are holding up better than the market. I will be managing these in the short term, while waiting for several candidates in my BUY list to hit their BUY points.

The price of oil is gathering lots of interest this week, with good reason. Do you think oil is headed for $100 per barrel. Voice your opinion in my latest poll. Click here to vote.

Cenovus Energy (CVE) Delivers - $254/100 Share Paycheck – 165.6% Annualized Gain.

Cenovus Energy (CVE) was stopped out on 4/12/24 delivering a $254/100 share (13.8% Gain). The gain was modest, but then so was the risk as the initial investment of $1841 turned into $2095. This was especially rewarding given the negative market environment of the last few days.

The trade went live on 3/13/24 at a price of $18.41. The annualized gain on the trade was 165.6% gain.

CVE operates in oil sands, offshore, and natural gas deposits along with refinery and energy transfer services. It has an excellent earnings record having beaten expectations in three out of its last four quarters. With the current situation in Russia, where Ukrainian drones are attacking Russian refineries, this trade should remain on the positive side.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.