Stocks started the week on uneven footing as the first installment of this week’s data dump, manufacturing PMIs were mixed with both the ISM and S&P numbers above 50, in growth territory, but with mixed trajectories while prices rose. The bond market didn’t like the data and yields climbed.

We could see more volatility as the employment data, starting with ADP’s private payrolls and JOLTS new jobs numbers come in ahead of Friday’s Non-Farm Payrolls.

I’m curious about your thoughts on Non-Farm Payrolls, so I’ve set up a poll to gather your opinion. Please vote here. The poll shuts down in two days, so don’t miss out.

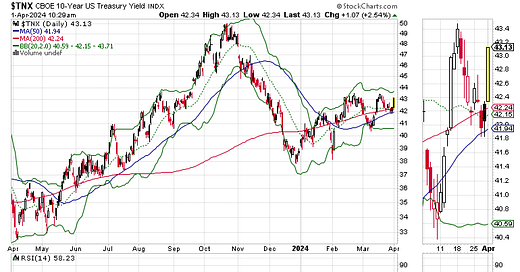

The Ten Year Note yield (TNX) moved to 4.3%, but is still within the 4.1-4.4% yield range. As I noted in this weekend’s Smart Money Weekly, a move above or below this range will be highly influential to stock prices.

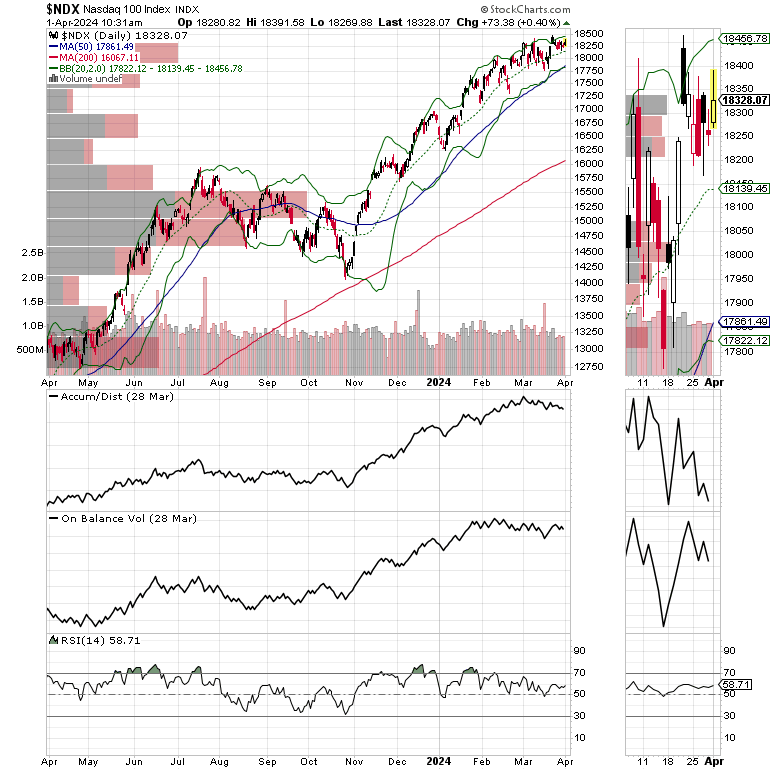

The Nasdaq 100 Index (NDX), where the big tech stocks reside, is holding up better than the S&P 500 (SPX). NDX has been under performing lately and some dip buying is evident this morning.

We have three open trades currently. All are holding their own, indicating that our paychecks are on the way. I also have one new trade this morning.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.