Mortgage Rates Fall Below 7% for the Second Week

Investors and home buyers face difficult choices

I remain cautiously bullish on the housing market and related investments. But recent developments suggest both potential home buyers as well as investors in the housing sector are faced with some difficult choices between the counter effects of recent mortgage rate drops, the employment situation getting murky, and the Fed staying put on rates.

Signs of Movement Emerge

In a sign that the market timers in the housing market are spreading their wings, one of the homes I’ve been monitoring in my neighborhood has finally sold as mortgage rates dipped below that magic 7% point in the past week. The sale date corresponded to the recent dip in mortgage rates below 7%.

This suggests, that as I’ve been expecting, that for some potential homebuyers the need for a home outweighs the combined risks of high price and the high mortgage rates. Indeed, it’s early innings for the summer housing market, as the market timers in the sector are making their move when rates drop. Yet, the market remains highly unpredictable, as an existing home I’ve been watching has cut its price again, the third time in a month.

That’s where we are, at a point where people need housing but inflation and perhaps a changing job market are influencing their decisions and ability to take the leap.

Rising Bearish Sentiment Persists. Patient Investors Will be Rewarded.

The bearish sentiment in the housing sector is so thick, it’s not just palpable, it’s pervasive. That’s why I’ve been bullish on the homebuilders and the housing REITs for the past several weeks. And according to the latest mortgage demand data, there are some encouraging signs emerging.

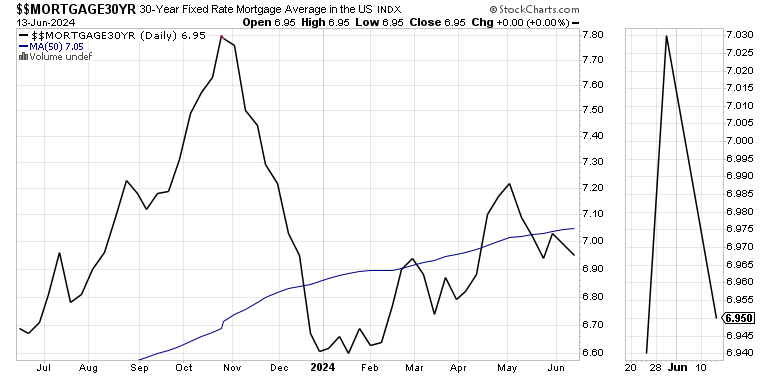

According to CNBC, the number of total mortgage applications for the latest reporting week rose by 16% with applications to refinance rising by 28% and 9% for applications to buy homes. What makes this most interesting is that CNBC is basing this data on numbers from the Mortgage Bankers Association which averaged 7.02%.

What that means is that, as I’ve been noting for some time, the key mortgage point is 7%. Moreover, the fear of high interest rates seems to be to a point where any loan which is just above, or just below 7% is attractive enough to those who qualify that demand booms when that key rate is approached.

As a result, when, as I expect will eventually happen, perhaps sooner rather than later, when 7% is finally breached, the pent up demand for mortgages will increase. On the other hand, given the decline in April payrolls, and the bumpy on and off rise in jobless claims, the panorama for housing, on the ground, and on Wall Street is becoming a bit hazy.

The Key is the Interplay Between Inflation Data, the Economy, and the Fed

We’ve already seen the Bank of Canada and the European Central Bank lower rates in the last few days. The two central banks lowered rates despite no major decline in inflation in either region. That suggests that both the ECB and the Bank of Canada are o.k. with inflation remaining at current levels while being more concerned about their economies slowing.

The Fed, on the other hand, seems to be more focused on the rate of inflation than on the potential slowing in the economy caused by inflation. That’s because the U.S. economy, although not growing as rapidly in the entire country as in some regions, when taken in aggregate is not falling apart.

Indeed, the Fed’s most recent FOMC meeting left both interest rates and the outlook for rate cuts in 2024 unchanged. So, unless something very drastic in the economy happens before the election, expect the Fed to move after November 5.

A closer look at the CPI data suggests that the rate of rise of inflation has slowed significantly, or at best flattened out. But that doesn’t remove the inflation that’s already in place. Anyone who goes to the grocery store these days can see that prices may not be rising, but certainly are not flattening out across the board.

Much of the U.S. economy’s ability to muddle through this inflationary period is due to the population shifts away from high tax, low employment states, to the Southern U.S. where, even though there are pockets of weakness, the employment options are still better than in other places. This population relocation has created an uneven rate of regional growth rates, which when averaged out comes out looking acceptable.

Yet, as recent GDP data, and private numbers such as purchasing manager’s data, continues to show regional disparities which are keeping the Fed from lowering rates as they fear that when they do, the stronger areas will be pushed into overdrive and revive the rate of inflationary growth.

Perhaps, the biggest unknown is what happens in the jobs market, where there are vast regional differences. For example, this morning’s jobless claims were pushed higher by a very large increase in California which some analysts are suggesting are due to the new $20 minimum wage laws and layoffs at fast food restaurants, which are becoming increasingly automated.

Supply and Demand and Location Still Favor Homebuilders and REITS

All of this brings us back to the central tenet of why housing is still a go to sector in this market, if mortgage rates and the economy cooperate. There aren’t enough single family homes available to accommodate the demand for those who wish to own one, especially in areas of the country which are growing.

That’s because homebuilders have reduced their starts and are slowing their rate of development, while offering incentives to eligible buyers. Simultaneously, individual home sellers can’t compete with the homebuilders. That means that what may be lower priced existing homes are scarce. This combination of factors gives homebuilders the advantage.

On the other hand, there is a potential glut of rental homes in some areas of the country; both apartments and single family, while shortages persist in others. This is a mixed bag for real estate investment trusts and private equity investors who’ve been buying new and existing single family homes and turning them into rentals.

Thus, it’s all about location and competitive rents.

For homebuilders, this build to rent dynamic (BTR) is a stealth money printing machine as Wall Street’s insatiable desire to own homes which produce rental income continues to work its way to the builder’s top and bottom lines.

For well managed REITs, it’s a potential cash cow as long as they remain prudent in the regions where they make the purchases while keeping their debt load manageable.

Bond Yields Portend Lower Mortgage Rates Next Week

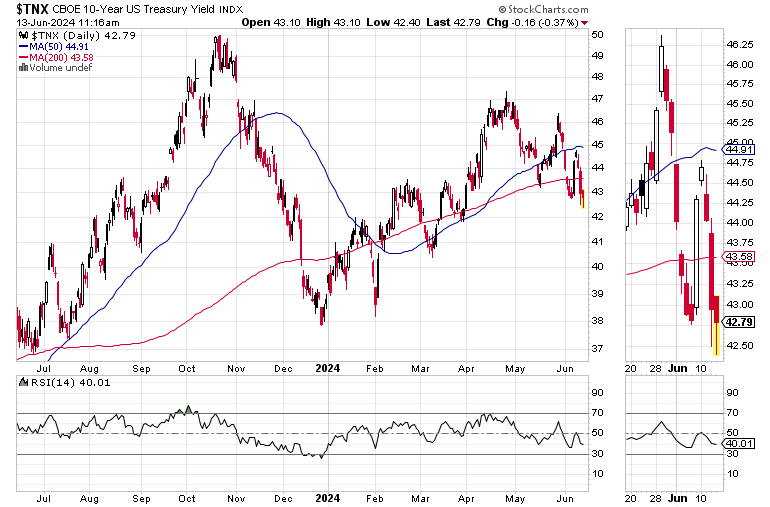

The U.S. Ten Year Note yield (TNX) crossed below 4.3% on 6/12/24. Unless, this is rapidly reversed, it is a bullish development for mortgage rates in the short term. That’s because mortgage rates tend to lag TNX by about a week. Thus, if there is no meaningful reversal in TNX by 6/20/24, the odds favor mortgage rates falling below 7%.

The bond market is factoring in the potential for flat inflation and a murky jobs market. For now, the bulls are in soft control with the U.S. Ten Year Note yield (TNX) remaining below 4.3%.

If mortgage rates fall decidedly below 7% the recent rise in mortgage demand is likely to increase. The latest average 30-year mortgage rate dropped to 6.95%.

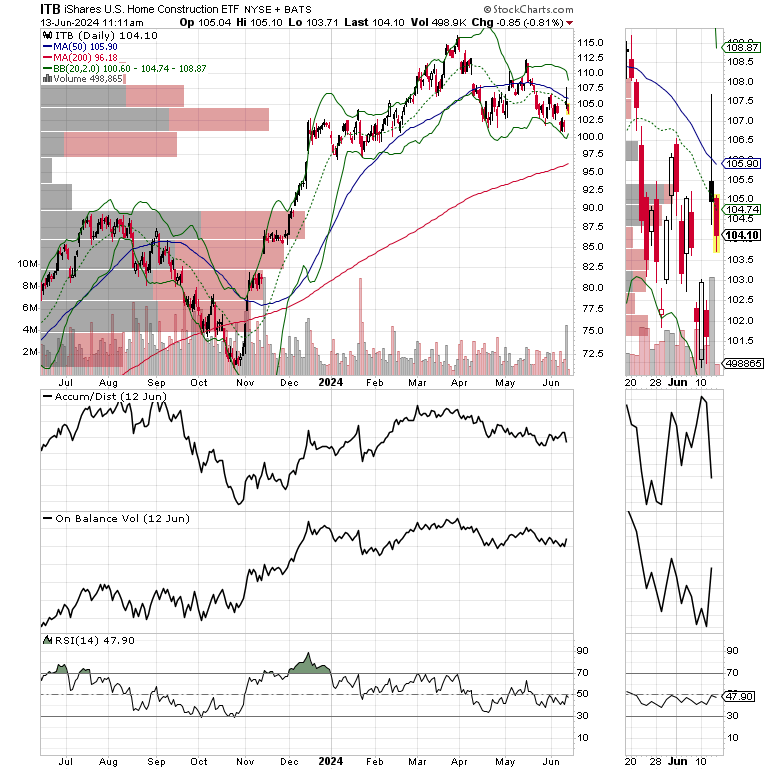

The iShares U.S. Home Construction ETF (ITB) illustrates the market’s current assessment of the situation for the sector. While ITB is moving sideways, the price continues to fluctuate based on news events. Short sellers are trying to knock the price down (declining ADI), while value investors are nibbling at the shares (rising OBV).

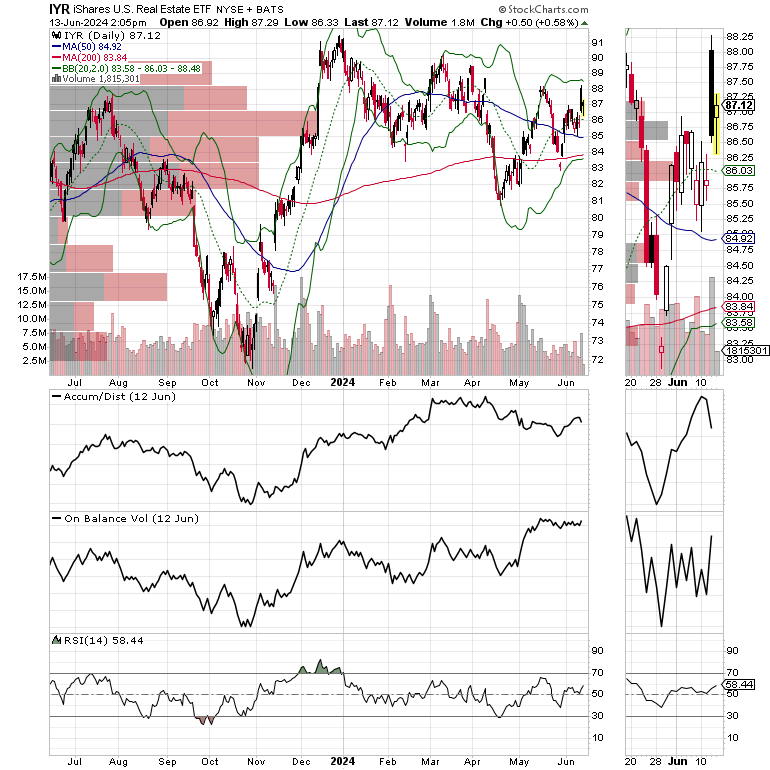

Meanwhile, the iShares U.S. Real Estate ETF (IYR) has a bit of wind behind its sails suddenly, as low interest rates and the prospects for an increase in renters due to the high price of buying a home boost the sector’s prospects.

Bottom Line

If mortgage rates remain near 7%, there will be buyers coming off the sidelines. New homes may be favored by some due to builder incentives and higher availability. Those who can't afford to buy a home are likely to opt for rentals. This favors single family home rental REITs.

On the other hand, there seems to be some potential volatility in the jobs market, which could derail plans for many.

The Fed is looking for a reason to cut rates but can’t seem to find one without looking as if they’re caving to presidential election politics.

For housing market investors, it all adds up to this being a good time to be patient.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.