Momentum/ESP Update: Watching the Dip Buyers. Bitcoin Explodes. And a New Very Stealthy Energy Stock for the ESP Portfolio.

Stay Alert. Trade what you see. Trust the charts not the noise. Trade One Stock at a time; one day at a time.

Image courtesy of vitalentum.net

Stocks are pulling back this morning as the familiar – bad tariff news triggers selling which is then reversed by the dip buyers – trading pattern unfolds; until it doesn’t. That’s where we are, caught in a bait and switch market which keeps on faking the unwary out and rising as the bad news headlines abate.

Yet, it’s not useful to fight the tape, which is what we’ve been doing since the April bottom. Certainly, a consolidation/pullback of some sort is likely to develop at some point, and this momentum rally will eventually crash and burn like all momentum rallies do; just not quite yet as far as we can tell.

So, the burning question remains whether the dip buyers will come in keep things going. This morning, there’s a bit of that going on for sure. But with earnings season and CPI next week, traders are a bit wary.

So, once again here are the simple trading principles which are paramount for the current environment:

The trend is up so we trade the long side

Be aware that any day could be the day that the momentum collapses

Retain positions which are working and ride the trend while ratcheting up or sell stops to protect gains and

Trade day by day.

In this issue, I am adding a new energy company to the ESP portfolio.

The second is an energy company which is being aggressively accumulated. I bought some shares in both this morning.

I am also updating all ESP and Momentum Monday positions and adjusting Sell stops to protect profits.

Market Update – NYAD Takes a Rest

The New York Stock Exchange Advance Decline line (NYAD) has been making new highs for the past few days and clearly needs a rest. The RSI failed to confirm the latest thrust so a trip back to the 20-day moving average may develop in the short term. Watch the RSI level at 50. If NYAD holds at the 20-day and RSI holds at 50, the odds of a continuation of the rally to the upside will be very favorable.

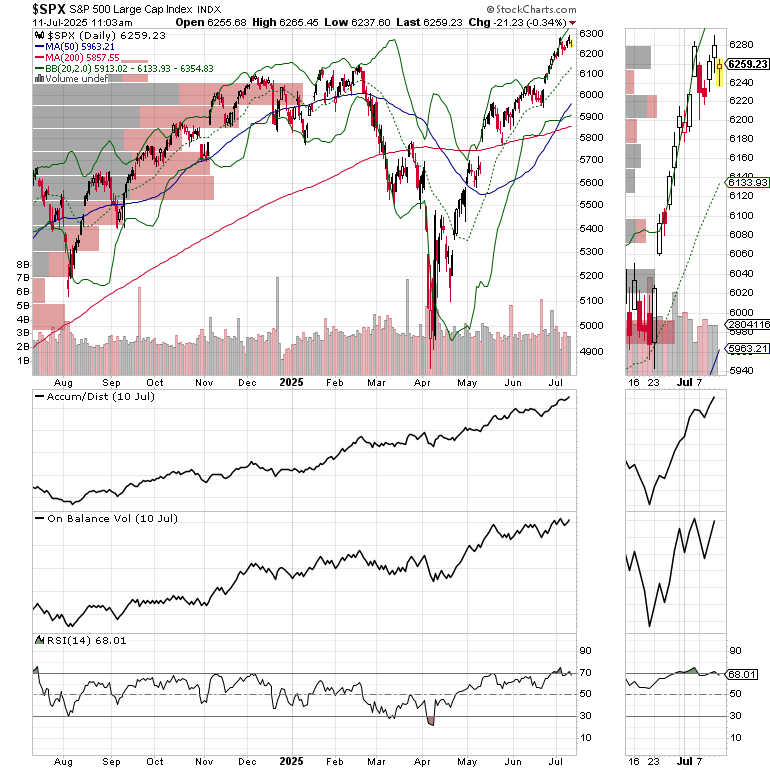

The S&P 500 (SPX) is displaying a similar technical picture to the NYAD. SPX is consolidating above 6200 currently. There is support is at 6100 and the 20-day moving average.

Bond yields are creeping higher. The U.S. Ten Year Note yield (TNX) is again testing resistance at its 50-day moving average while holding above its 200-day moving average. Let’s see what happens at 4.5%.

Bitcoin has finally delivered its highly expected breakout. Our Bitcoin ETF trade is up nicely and I’ve raised the Sell stop to preserve profits.

Thank you all for your support. If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot – pre-order now. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, and a 60% discount offer check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Products Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.