Momentum/ESP Update: Options Expiration Leans Bullish and Quirky. New Seasonal Trade for Hurricane Season.

Stay Alert. Trade what you see. Trust the charts not the noise. Trade One Stock at a time; one day at a time.

Image courtesy of storyblocks.com

In this issue, I am adding a new seasonal trade and recommending taking profits on a short term trade which has already delivered over $1000 in paper profits.

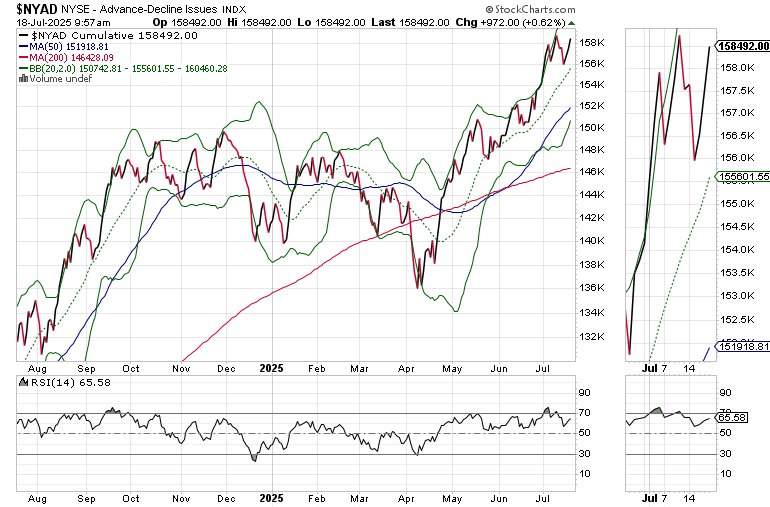

The summer rally continues. Stocks recovered after a slight swoon earlier in the week with the S&P 500 (SPX) delivering a new high as the New York Stock Exchange Advance Decline line (NYAD) is slightly lagging but well within reach of confirming the new milestone.

Nevertheless, with options expiration taking hold of trading today, expect some volatility as ODTE (zero day to expiration) trading takes hold of the market. This short term trading tactic has increased significantly over the last few years, more so lately, and often creates haphazard trading in individual stocks on expiration day.

Don’t Fight the Momentum. Just keep an Eye out for reversals.

With the momentum to the upside having recovered after a brief respite earlier this week, our trading plan remains geared toward a rising market. Thus, we continue to adhere to these simple trading principles.

The trend is up so we trade the long side

Be aware that any day could be the day that the momentum collapses so

Take some profits if called for

Retain positions which are working and ride the trend while ratcheting up or sell stops to protect gains and

Trade one stock at a time, one day at a time.

Market Update – NYAD Rolls Over – Slight Divergence Develops

The New York Stock Exchange Advance Decline line (NYAD) is within reach of a new high, which is important since SPX has recently delivered a new high. Confirmation from the NYAD on a new high by the indexes is bullish. The 20-day moving average survived its recent test of support on NYAD. Yet, we need a new high within the next few days to fully confirm the uptrend.

The S&P 500 (SPX) made a new high this morning behind the strength of large cap tech stocks. 6100-6250 and the 20-day moving average are important support.

Bond yields are still stuck in their recent trading range. The U.S. Ten Year Note yield (TNX) is testing the support of its 50-day moving average after briefly rising above the key line. The key is whether TNX cracks 4.5%. If that happens, it would be a negative for stocks.

Thank you all for your support. If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. For active traders there’s no better alternative than the Smart Money Passport. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, check out the Smart Money Passport. Trade better with extra energy, and vitality. Visit my Health Products Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.