Momentum Monday: Tug of War Between Bulls and Bears Resumes in Data Laden Week.

Plus, a New Momentum Trade and Update on a Position with Nearly $4000 in Paper Profits.

This week is shaping up to be what could be a make or break week.

Stock traders are on pins and needles after last week’s breadth driven rally in which the New York Stock Exchange Advance Decline line (NYAD) outperformed the major indices. Investors are jittery to start to the week as big tech earnings, Apple (AAPL) and Amazon (AMZN) lurk while the Fed’s favorite inflation measure the PCE is due out later in the week.

Image courtesy freepik.com

For what it’s worth, the CNN Greed/Fear Index opens the week at 35, well above its recent low of 4. The Put/Call ratios skewed toward the fear side with the overall P/C at 0.87 (showing moderate fear), while the Index P/C ratio was at 1.55, a very high reading suggesting that institutional investors are not taking any chances.

Market Update

The New York Stock Exchange Advance Decline line (NYAD) is moving decidedly higher adding to the bullish short term trading conditions. NYAD blasted through its 50-day moving average last week, delivering a nifty momentum thrust while the CBOE Volatility Index (VIX) fell. Combined these two indicators ended the week favorably. This morning

The S&P 500 (SPX) is also moving higher this morning. SPX cleared the 5400-5500 area last week and now faces resistance at the 5600-5700 area. The ADI and OBV lines suggest money came into both indexes confirming the short term bullish turn in the market highlighted by NYAD.

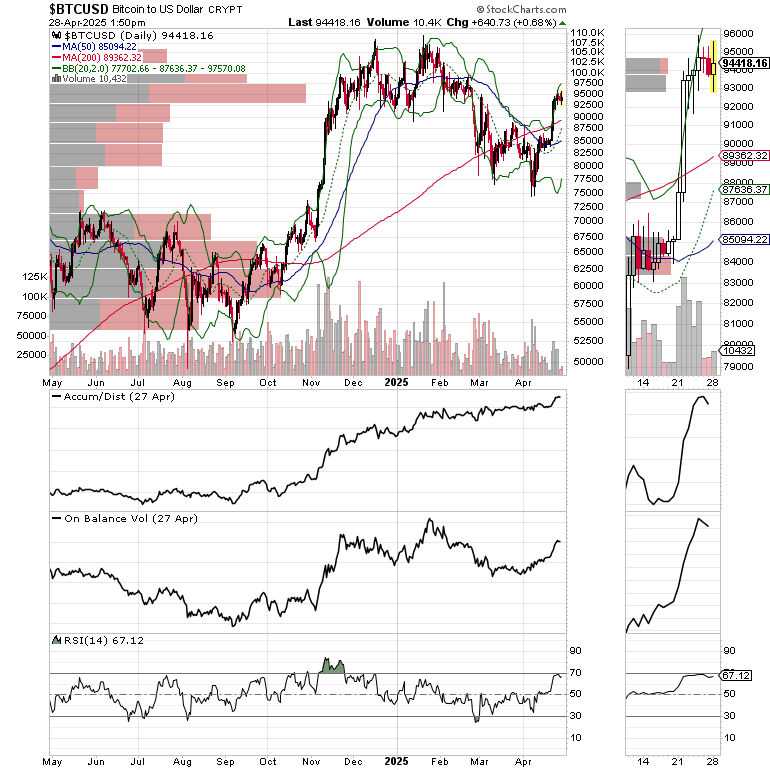

Bitcoin continues its positive turn as it straddles $95,000. A clean break above this area will likely take BTC above $100,000. Our current Bitcoin trade was well timed and is now in the money.

The U.S. Ten Year Note yield (TNX) remains range bound between 4.2 and 4.5%.

This morning, I am posting a new momentum trade and updating the portfolio especially a trade which we’ve let run for a while and has amassed nearly $4000/100 shares profit.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.