Momentum Monday – Taking $685 Profit on Novartis. Plus, a Low Risk High Potential Reward Option Play

Why homebuilder stocks are bucking the down trend.

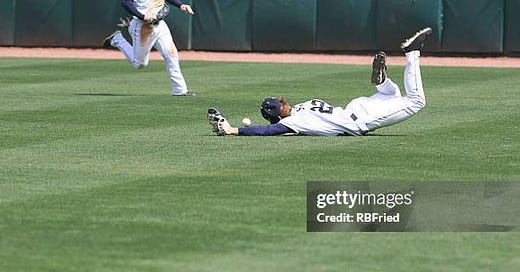

Like an outfielder who missed the big catch, stocks are again floundering this morning. Yet, we are taking a respectable $685 profit on Novartis. Together with last week’s profit on our BROS call option, that adds up to $937 in profits over the last two weeks. This morning I’m adding a new low risk, high profit potential option trade.

• SOLD Novartis (NVS). Bought 2/24/25: $109.50. SOLD 3/10/25: $116.35. Return for this trade: $685/100 shares (6.25%).

• SOLD Dutch Bros (BROS) April 17, 2025 $77.50 Call Option. Bought 2/24/25: $4.60. 3/3/25 intraday price: $7.12. Return for this trade: $252/contract (35%).

Image courtesy of Getty Images

Market Update

It looks as if the bulls missed the big catch and stocks are heading lower in the short term. The major indexes are struggling to find support while the New York Stock Exchange Advance Decline line’s expanding decline suggests the selling isn’t nearly done yet.

Perhaps the most troubling sign this morning is that New York Stock Exchange Advance Decline line has broken below its 50-day moving average and is now sliding comfortably lower along its lower Bollinger Band with a moderate distance between its current location and an oversold reading of 30 on the RSI. That means we are not quite there yet.

Meanwhile, the U.S. Ten Year Note yield (TNX) has turned lower this morning after briefly crossing above its 200-day moving average last week. This raises the possibility of a test of the 4% area.

If there is an upside to the current decline in yields (brought about by expectations of the U.S. falling into a recession) it’s that the homebuilder stocks (SPHB) have picked up a bid. Notice the bullish setup in the very long term chart for the S&P 500 Homebuilding Subindustry Index. First, note the October 2024 top which is highlighted by the index crossing above the upper Bollinger Band, which corresponds to two standard deviations above the 200-day moving average. That’s a long term top. Note the decline during which prices fell to the lower Bollinger band. Also note that the March 2025 lower low in SPHB corresponded to a higher low in the RSI (diverging blue lines). This is a sign that a tradeable bottom in the homebuilders is unfolding. Note that a move above the 2700 area, where two large VBP bars reside would confirm the move to the upside and that the next target for SPHB is 3000.

I have recently added five homebuilder stocks to my Weekender Portfolio long term focus holdings and have been nibbling at the strongest stock in the sector in my ESP portfolio here at the Smart Money Passport. The next ESP update is tomorrow.

Bottom line: Hold large amounts of cash. Nibble at homebuilders. And wait for the next buying opportunity.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership. Two new trades were posted yesterday.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. Receive a Free one month subscription to the Weekender portfolio with your first purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.