Momentum Monday: Stocks Take a Breather and Bond Yields Creep Higher. Plus, Two New Picks.

The real question is whether they will once again buy the upcoming dip.

As has been the case lately, stocks are taking their cue from the bond market with the U.S. Ten Year Note yield (TNX) slowly extending the distance from its recent floor at 4%. This should come as no surprise given the structural nature of inflation, which I described in detail over the weekend.

On the brighter side, the rise in bond yields is about to run into what could be a decisive wall of resistance as the 4.2% area and the 200-day moving average are just above this morning’s yield. A move above the 4.2% yield area would have at least a short term negative effect on stocks. On the other hand, the next major resistance level is 4.3%, which has been a successful turning point in the past. One thing is certain, the RSI for TNX is closing in on 70, which would make it overbought as it nears the critical 4.2-4.3% resistance band.

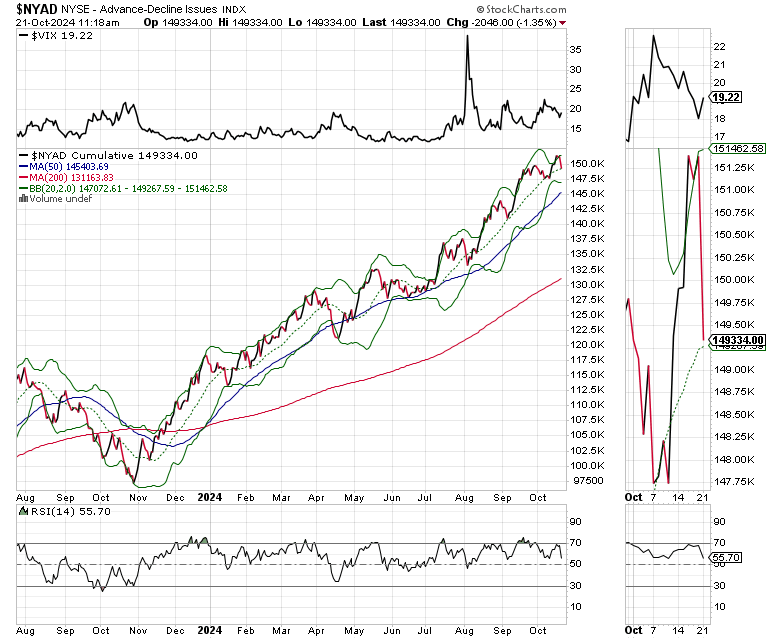

For its part the New York Stock Exchange Advance Decline line (NYAD) has rolled over this morning after courting the RSI 70 area over the last few weeks. The most recent tag of 70 was lower than the previous tag which means the rally was losing momentum. A test of the trading band between the 20 and 50 day moving averages is likely before the trend makes a longer term decision.

This morning, I am updating our Momentum portfolio with two new trades. Tomorrow I will have a full Extended Stay Portfolio update.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

Below, I have listed the full results of the portfolio’s trading results since its inception:

Recently SOLD Momentum Stocks

· SOLD Apple Inc. (AAPL) Above $225. Bought 9/19/2024: $225.05. SOLD 10/18/24 intraday price: $235.78. Return for this trade: $1073/100 shares (4.76%).

· SOLD - DAC. Bought 9/24/24: $84.05. SOLD 10/14/24: $85. Return for this trade: $95/100 shares (0.76%).

· SOLD Texas Instruments (TXN). Bought 9/27/24: $210. SOLD 10/15/24 intraday price: $200. Return for this trade: $1000/100 shares 4.76%.

· SOLD UFP Industries (UFPI). Bought 10/8/24: $129.50. 10/14/24 intraday price: $138.19. Return for this trade: $869/100 shares (6.71%). SOLD - Generac Holdings (GNRC). Bought 9/30/24: $157.55. 10/7/24 intraday price: $172.72. Return for this trade: $1258/100 shares (9.62%).

· SOLD Aris Water Solutions (ARIS). Bought 9/23/24: $17.25. SOLD 9/26/24: $16.35. Return for this trade: $90/100 shares (5.21%).

· SOLD - Louisiana Pacific (LPX). Bought 9/13/24: $97.50. 9/23/24 intraday price. $104.50. Return for this trade: $700/100 shares (7.94%).

· SOLD Sterling Infrastructure (STRL). Bought 9/17/24: $130.05. SOLD 9/19/24 intraday price: $139.60. Return for this trade $955/100 shares (0.734%).

· SOLD - PulteGroup Inc. (PHM). Bought 9/10/24: $131. SOLD 9/19/24 intraday price: 141.40. Return for this trade: $1040/100 shares (7.93%).

· SOLD– Duke Energy (DUKE). Bought 8/30/24: $113.50. SOLD 9/18/24: $116. Return for this trade: $250/100 shares (2.2%).

· SOLD - ProShares Ultra QQQ ETF (QLD) above $92.50. Bought 8/14/24: $92.50. SOLD 9/6/24: $92.50. Return for this trade: EVEN.

· SOLD - Aecom Technology (ACM). Bought 8/23/24: $97.50. 8/26/24 intraday price: $98.60. SOLD 9/6/24: $95. Return for this trade: (-) 260/100 shares (2.63%).

· NVDA Straddle:

o Leg 1 - CLOSED - September 13, 2024 $136 Call Option. Bought to open 8/26/2024: $6.15. SOLD to close. - 8/29/2024 intraday price: $1.79. Return for this leg: - $436/contract (70%).

o Leg 2 - CLOSED September 13, 2024 $123 Put Option Bought to open 8/26/24: $6.05. SOLD to close: 8/29/24: $6.85. Return for this leg: $80/contract (+13.22%).

· Buy to Open the Berkshire Hathaway Class B (BRK/B) October 18, 2024 $460 Call Option Up to $7. Bought 8/19/24: $6.39. Bid/Ask on 8/26/24: $10.60/$10.80. Sell Stop: $9.50. Stopped out 8/26/24: $9.50. Return for this trade: $311/contract (48.6%).

· SOLD Simon Property Group (SPG). Bought 8/9/24: $157. SOLD 8/26/24 intraday price: $167.89. Return for this trade: $1089/100 shares (6.93%).

· SOLD - ProShares Ultrashort S&P 500 ETF (SDS). Bought 8/2/92: $23.93. SOLD 8/8/24: $24.75. Return for this trade: $82/100 shares (4.26%).

· SOLD Applied Materials (AMAT) Above $190. Bought: 8/6/24: 190.05. SOLD: 8/7/24: $183. Return for this trade: (-) $705/100 shares (- 5.%).

· SOLD - Sterling Infrastructure (STRL) above $120. Bought 7/22/24: $120.03. SOLD 7/24/24: $114. Return for this trade: - $603/100 shares (-5.02%).

· SOLD: Morgan Stanley (MS). Bought 7/1/24: $98.10. SOLD 7/15/\: $107.85. Return for this trade: $975/100 shares (9.93%).

· Expired: Texas Instruments (TXN) July 19, 2024 $210 Call Option. Bought to Open 6/12/2024: $2.03. Return for this trade: -$203/contract.

· Expired: Open the Builders First Source (BLDR) July 19, 2024 $175 Call Option up to $4.00. Bought 5/24/2024: $6.50. Return for this trade: -$650/contract.

· SOLD Verizon Communications (VZ). Bought 7/18/24: $42.13. SOLD 7/22/24: Stop: $39. Return for this trade: - $313/100 shares (-7.4%).

· SOLD Celestica Inc. (CLS). Bought 6/18/24: $58.75. SOLD 7/18/24: $59. Return for this trade: $25/100 shares. Even.

· SOLD SPX Corp. (SPXC). Bought 6/20/24: $141.35. SOLD 7/12/24 $156.37: Return for this trade: $1502/100 shares (10.7%).

· SOLD Advanced Microdevices above $171. Bought 7/5/24: $171.05. SOLD 7/11/24 $185.75. Return for this trade: $1470/100 shares (8.6%).

· SOLD – Cheniere Energy (LNG). Bought 6/24/24: $165.50. Sold /28/24: $174.27. Return for this trade: $877/100 shares (5.29%).

· SOLD - Clearwater Analytics (CWAN). Bought 6/5/24: $19.39. SOLD 6/25/24: $18.50. Return for this trade: $89 per 100 shares (-4.81%).

· SOLD Direxion Semiconductor Bull 3x Shares. Bought 6/10/24: $53.50. SOLD 6/17/24: $59.36. Return for this trade: $586/100 shares (9.05%).

· SOLD - Micron Technology (MU) Above $130. Bought 5/24/24: $130.05. SOLD 6/12/24: $141.34. Return for this trade: $1129/100 shares (8.68%).

· SOLD - Guidewire Software (GWRE) above $124. Bought 5/20/24: $124.05. SOLD 5/29/24 $115. Return for this trade: (-) $905 per 100 shares (-7%).

· SOLD - Micron Technology (MU) Above $124.50. Bought 5/15/24: $125.50. SOLD 5/23/24: $128.50. Return for this trade: $300 per 100 shares $2.4%.

· SOLD KB Home (KBH). Bought 4/24/2024: $66.05. Intraday price 5/20/24: $72.88. Return for this trade: $683 per 100 shares (10.34%).

· SOLD Texas Instruments Inc. (TXN). Bought 5/6/22024: $180.05. Intraday price 5/20/24: $196.62. Return for this trade at current price: $1662.57 per 100 shares (4.69%).

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.