Momentum Monday: So Far, So Good. Let's See if they Can Hold the Gains.

Taking an $870 profit and setting up a new high potential momentum trade

We’re starting the week on an up note as I recommend closing out a two part trade which I posted last week on Palantir (PLTR). While the short term trade has delivered, a more nuanced intermediate term trade is still active.

• SOLD - Palantir (PLTR) Above $85 – Momentum Approach. Bought 4/9/25: $85.05. SOLD 4/14/25: $93.75. Return for this trade: $870/100 shares (9.28%).

Image courtesy of valuewalk.com

Market Update

The market is in recovery mode this morning following through on last Friday’s turnaround. This is at least a short term positive. But, of course, everything could change rapidly on any new tariff related headlines or events. That means that we remain watchful and prepared for sudden turns.

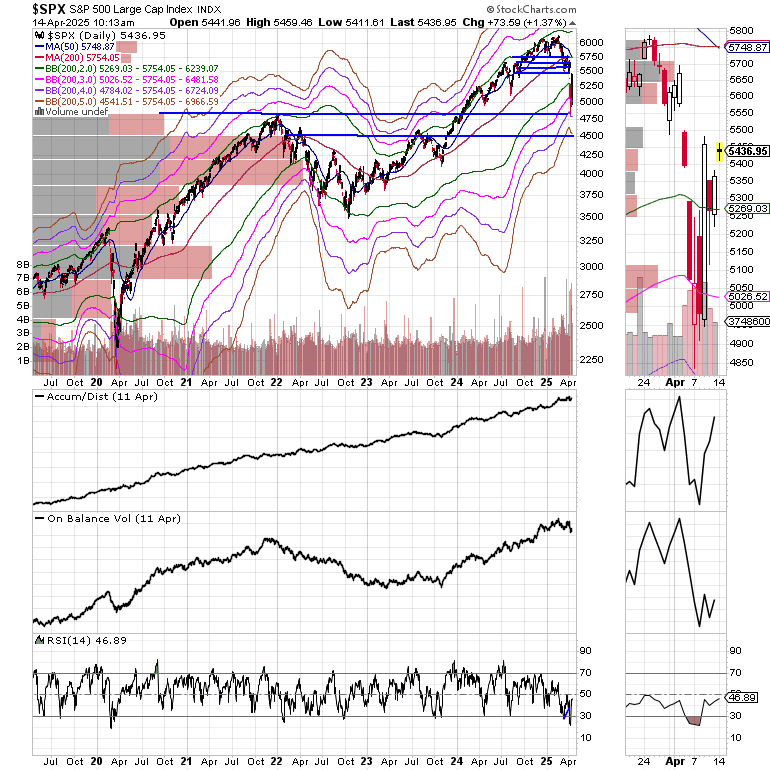

This morning, the S&P 500 (SPX) gapped higher but is stuck just below 5450. The good news is that the support provided by the lower Bollinger Band placed two standard deviations (2SD, green line) below the 200-day moving average is holding.

As I noted last weekend last week’s momentum tag of the 4SD Bollinger Band (pink line), similar to the 4SD tag in March 2020, suggested that the market was well oversold and a reversal to the mean, the 200-day moving average was brewing. That said, there’s a lot of talk about the “death cross” of the 50-day moving average falling below the 200-day moving average, which suggests that, at least in the short term, the declining 50-day moving average might be a short term resistance level before the market tests the 200-day moving average resistance area.

As the chart shows, a similar occurrence developed in March 2020 (tag of 4SD and 50/200 death cross), which was inconsequential as the market continued to recover. The one factor that spurred the rally’s continuation was the Fed’s massive QE, which in this case, has yet to materialize.

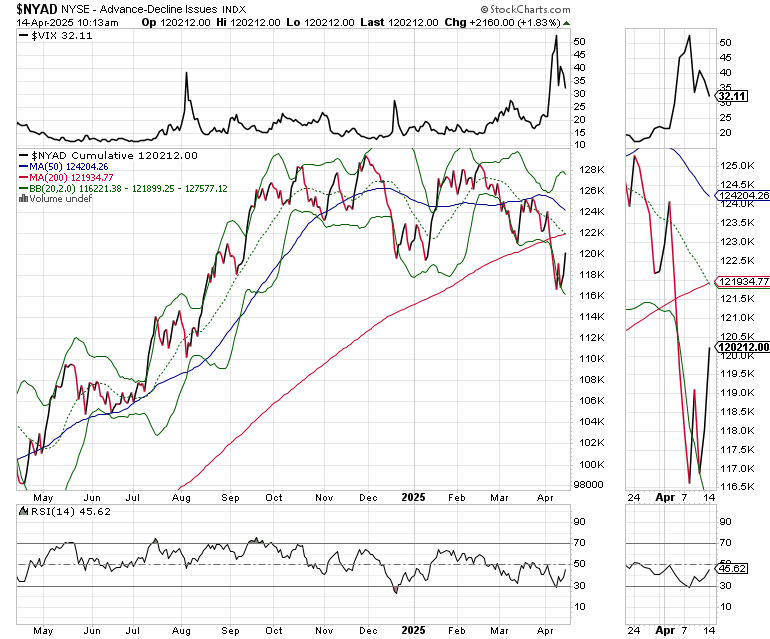

The New York Stock Exchange Advance Decline line (NYAD) has recovered after tagging its lower 2SD Bollinger Bands. This is encouraging as it suggests the market is returning to a more “normal” trading pattern.

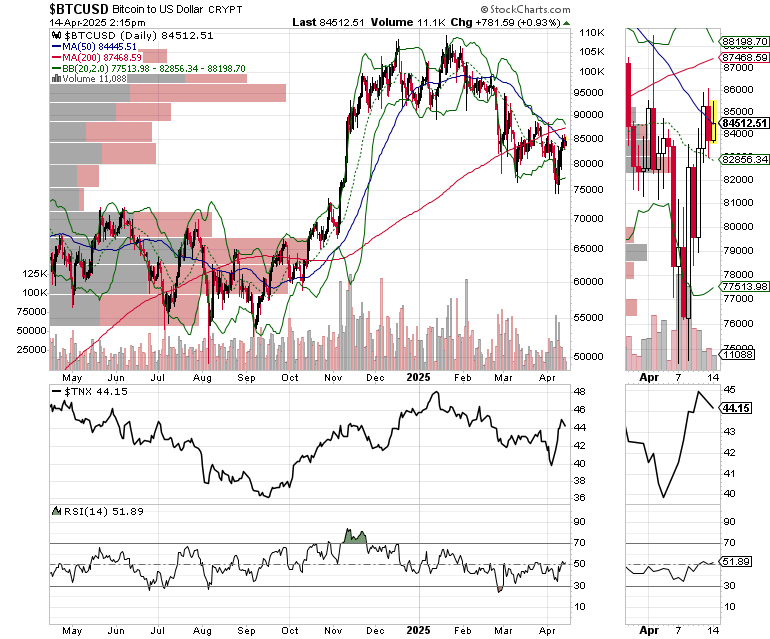

Bitcoin has stopped falling and looks set to test its 200-day moving average. A move above that resistance level would likely signal the market’s concerns are stabilizing.

The U.S. Dollar, is below $100 but is well oversold (outside its 2SD line with an RSI of 30).

The U.S. Ten Year Note yield (TNX) is trying to reverse its recent climb. Yet, persistent rumors of Chinese selling its holdings continue to push yields up.

This morning, I am posting a new trade with big potential upside ahead of earnings.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.