Markets Under Pressure. Breadth Tests Support. QQQ Hangs by a Thread.

There is always a Silver Lining. For now – Lots of Cash and a Narrow Focus.

“She might get out her nightstick, and hurt me real, real bad; by the roadside in a ditch. She’s got me under pressure.” - ZZ Top, Eliminator.

There’s enough pessimism in the air to launch a massive bull market. Yet, tightening liquidity, a falling dollar, along with geopolitical and domestic uncertainties are still weighing on the markets. In addition, both the major indexes and the New York Stock Exchange Advance Decline line broke below key support areas last week. The only alternative is to wait and keep your powder dry.

Image courtesy of forexgdp.com

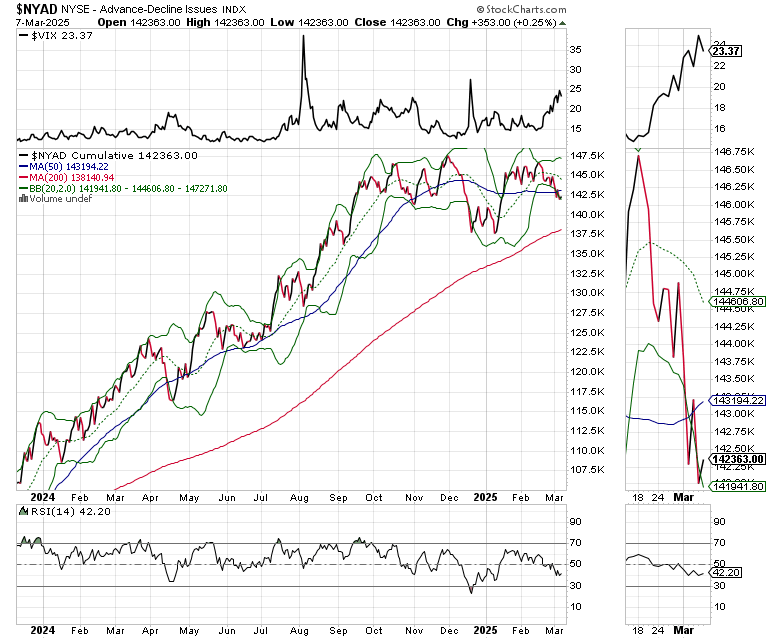

Life imitates art, which is why the above quoted refrain from the blues rock classic “Under Pressure” about a lover’s tryst gone awry by iconic Texas blues rockers ZZ Top is an appropriate description for this market, as every day feels as if someone is taking a nightstick to the trading crowd. I’ve been patient with the action for the past few weeks, relying on the market’s breadth, as in the New York Stock Exchange Advance Decline line (NYAD) as a sign that we were in a rotation. But the venerable indicator has broken down, as I detail below, suggesting that if the market doesn’t perk up soon, things are about to get worse.

Yet, if history holds up, the level of bearish sentiment that has accrued is more than enough to trigger a meaningful rebound under the right conditions.

If you’ve followed our recommendations, you’ve reduced your stock holdings over the last few weeks, via profit taking or being stopped out, raising cash, and narrowing your focus, positioning yourself for the next buying opportunity.

The Silver Lining – With So Much Pessimism All It Takes is a Spark to Trigger a Turnaround

The sun always rises, and there is always a silver lining – although sunrises can be cloudy, and silver linings can hide for extended periods. In this market, the silver lining is the level of fear, which is at a point where the trend is set up for a turnaround. The reason we haven’t seen one yet is that there has been no catalyst to mark the bottom.

That’s because volatile headlines trigger algo related volatility. When you add the Federal Reserve’s recent hawkish turn to the equation, things get even murkier.

But here’s the good news. There is so much bearishness around that the market is ripe for a turnaround. All that’s needed is a spark. In other words, a geopolitical breakthrough, something positive in the domestic arena, or a dovish turn from the Fed would likely trigger a bottom; perhaps similar to 2020 during the pandemic where the bearish sentiment was extreme as the markets were crashing and the Fed began QE.

Bond Yields Rebound as Expected from Oversold Condition. The Dollar is Increasingly Weak.

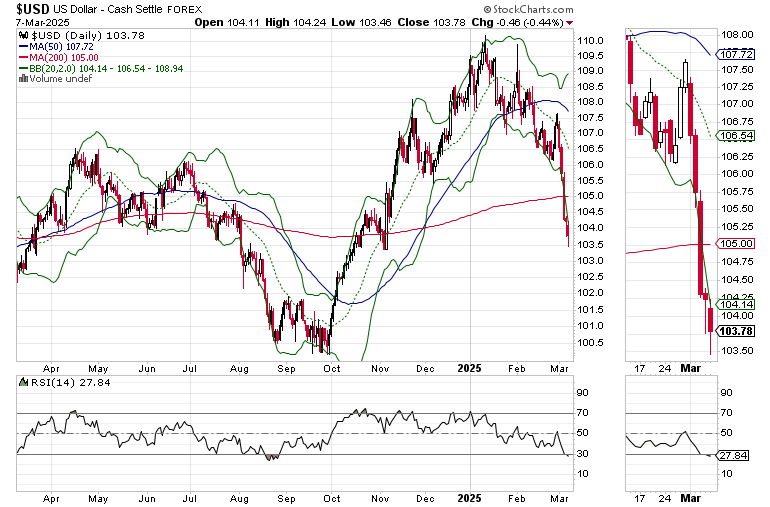

Bond yields hit their lows for 2025 last week and have rebounded. But the elephant in the room may be the dollar, which has broken below key support. The U.S. Dollar Index (USD) has broken below its 200 moving average as money seems to be leaving the U.S. A recent beneficiary seems to be Europe, especially Germany and the U.K, especially pharmaceutical stocks. On the other hand, USD is very oversold (RSI near 30 and trading outside the lower Bollinger Band), so the next few days will set the stage for what’s next.

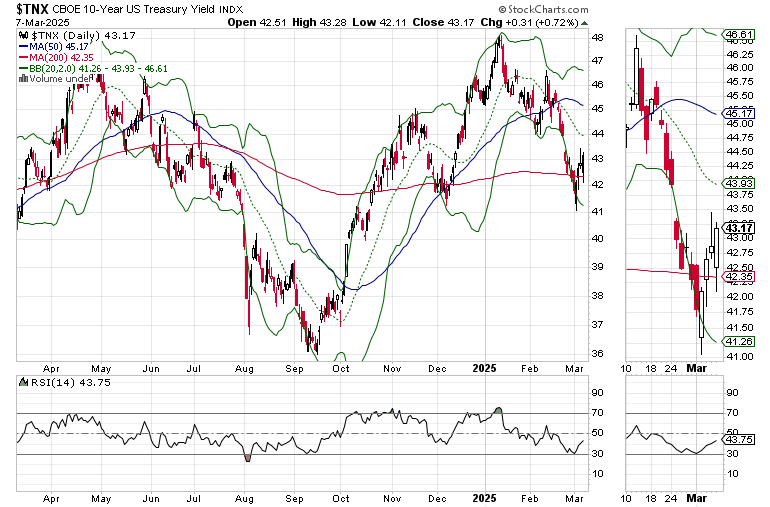

The U.S. Ten Year Note yield (TNX) is once again above its 200-day moving average with the potential to rise to 4.5% and its 50-day moving average. This is not unexpected, as the RSI for TNX was near 30 last week, an oversold reading. Thus, this bounce was not unexpected. Keep an eye on the 50-day MA. A major breach of that level could spell big trouble for the markets, while perhaps triggering a reversal on the dollar.

Bearish Sentiment Persists

Here is the market’s current background:

• The CNN Greed/Fear Index (GF) closed the week in the Extreme Fear area, with a reading of 20, after falling as low as 14 last week. This is bullish from a contrarian standpoint and compares to an Extreme Greed reading 73 one year ago and a reading of Fear (38) a month ago. Markets rarely descend into long term bear trends during periods of high fear. But extreme fear is not enough to keep the short term from getting worse.

• The Put/Call ratio hit 0.95 on 3/6, a cautious reading, but not enough to signal the all-out panic which usually precedes a major market bottom. The recent high for CPC was just above 1.0 in early 2025, a neutral reading. The prior meaningful market bottoms, which led to long term rallies followed P/C ratios of 1.25 (8/24) and 1.30 (11/24). A similar peak in this indicator in the near term could again signal a market bottom.

• The New York Stock Exchange Advance Decline line (NYAD, fell below its 50-day moving average last week. If it does not recover convincingly, expect more downside action in stocks.

• Liquidity tightened. The Fed’s National Financial Conditions Index (NFCI) rose to 0.59 from the prior week’s 0.67.

Bottom line: The market is closing in on a bounce. But a lasting market bottom is less likely while there is no panic from options traders.

Lots of Cash and a Narrow Focus

It’s getting harder to find sectors to trade, so holding lots of cash, while being aware that a buying opportunity could arrive at any moment is appropriate. Last week, the QQQ Trust (QQQ), dropped below its 200-day moving average as the selling pressure picked up and is now hanging by a thread. Note the downward trend in the OBV, a clear sign that sellers are now in charge. QQQ is oversold, but if the $480 area doesn’t hold, expect a move toward the $460 area or below before a meaningful bounce develops.

Few areas of the market are attracting money. One of them remains healthcare, although the flows have slowed into many areas of the broad sector, except pharmaceuticals, where the European shares are gathering steam.

The Health Care Select Sector SPDR Fund (XLV) is holding up, consolidating after its recent rally. We’ve been adding European pharmaceutical stocks at the Weekender Portfolio and the Smart Money Passport for the past few weeks. XLV is among our ETF holdings at the Sector Selector Portfolio. I own shares in XLV

As I noted last week, the iShares Home Construction ETF (ITB) looked listless; so much in fact that one gets the feeling the worst is over, although it may take a while before a long lasting reversal and a subsequent rally takes hold. And I may be early, but I’ve just added five homebuilder stocks to my very long term focused portfolio here.

If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better and longer with more energy and vigor. Visit my Health Page.

NYAD Falls Below Support

The New York Stock Exchange Advance Decline line (NYAD) broke below its 50-day moving average, driving a nail into the bulls. A failure of NYAD to recover meaningfully will signal an acceleration of the down trend.

The Nasdaq 100 Index (NDX) broke below its 200-day moving average but held near 19750, the last major support level before selling becomes more aggressive. NDX is very oversold, but the limited support below suggests it could fall to 18,000-18,250 before any meaningful rebound takes hold.

The S&P 500 (SPX) held at its 200-day moving average, but the next support if it fails to hold at this level is 5450.

VIX Crosses Above 25

The CBOE Volatility Index (VIX) is hovering near 25. This is cautionary.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading – Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)