This morning’s response to the employment data can best be summed up as: it could be worse. The lack of a meltdown in bonds is a bonus.

The financial markets responded in unexpectedly calm fashion to this morning’s well beyond expectations Non-Farm Payrolls number. This is a sign that we are entering a “new normal” phase where investors are less focused on rate cuts and seem to be glad that at least the Fed isn’t likely to raise rates further.

The Numbers Summarized – Poll Respondents Got It Right.

The latest U.S. Non-Farm payrolls figure was a whopper with over 300,00 new jobs created. Hats off to those that voted in my recent poll, who got it right with 75% of respondents saying that the number would be above 200,000. I’ll be posting a CPI expectations poll by the weekend.

Usually, this much of a beat would lead to bond traders freaking out and selling off treasuries. But, as I will detail below, no such thing happened. That’s because the “innards” suggest that many new jobs may be part time workers, while wages rose only as expected.

Bond Yields Remain Range Bound in Uneasy Calm

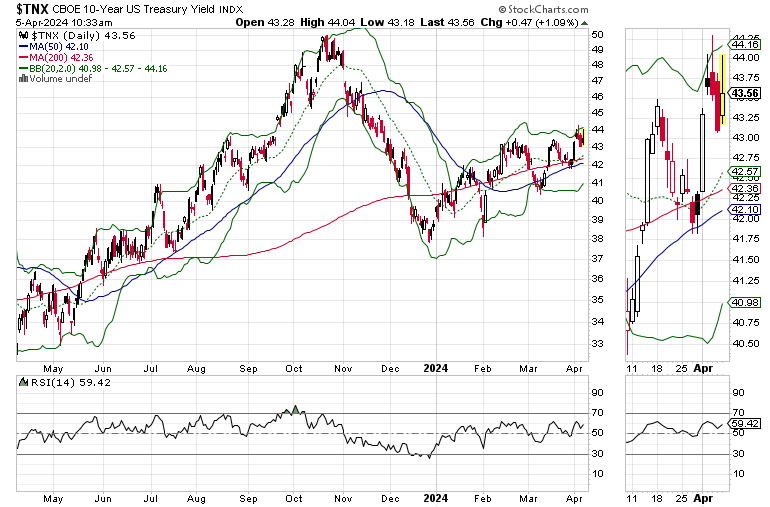

Perhaps the biggest event of the day was the lack of a bond yield massacre. The U.S. Ten Year Note yield (TNX) remarkably remained below the crucial 4.4% yield point. This matters because it suggests that bond traders are no longer completely unhinged about inflation. This in turn is, on balance bullish for stocks, especially some of the interest rate sensitive sectors.

Still, this is an uneasy calm as TNX remains near a potential breakout to a new up leg, which would be bearish for stocks and mortgage rates. TNX remains above its 50 and 200-day moving averages but has failed in its recent attempts to climb above 4.4%. The longer bond yields refrain from popping above that key rate, the more the markets can breathe a sigh of relief.

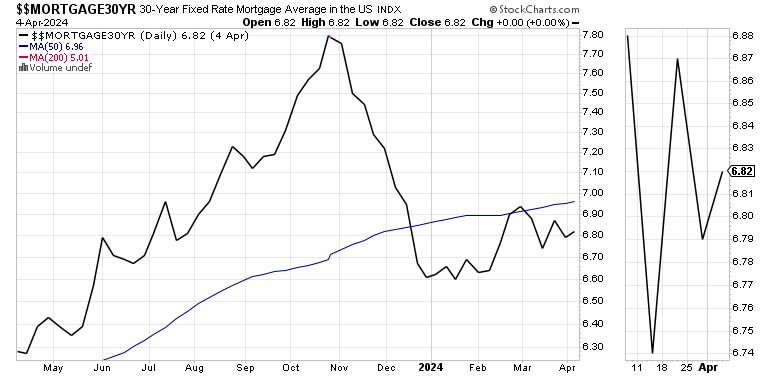

For their part, mortgage rates rose last week but failed to move above their key rate point, which is 7%.

Housing Roundup

I had a short conversation with a realtor this week, who told me that she is noticing an encouraging rebound in home buying interest, as she waited for her clients to show up for a viewing. She was less enthusiastic about the rental market.

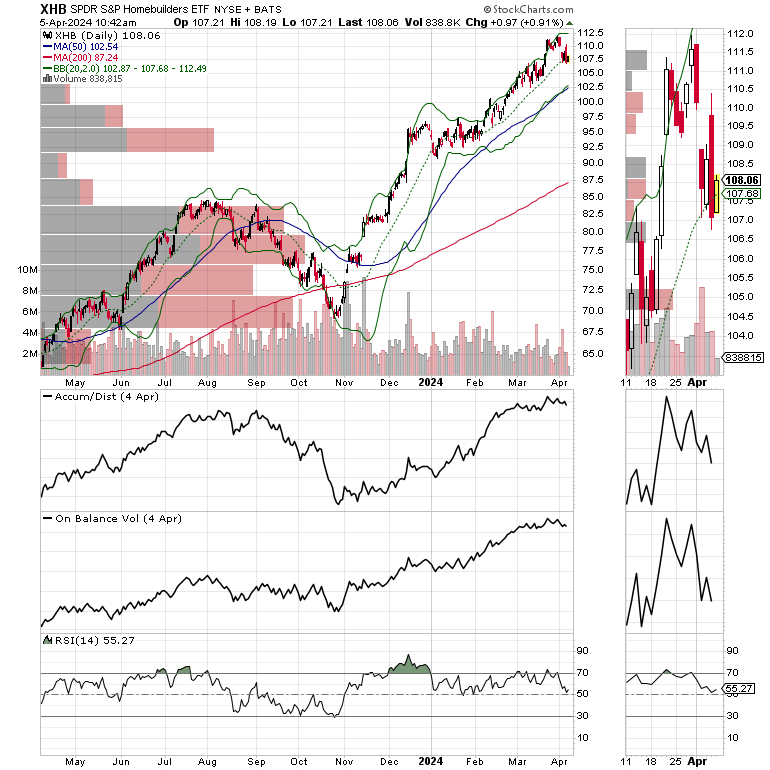

The SPDR S&P 500 Homebuilders ETF (XHB) is testing short term support at its 20-day moving average. Much of what happens to this ETF will depend on what happens to TNX and mortgage rates. Certainly, supply remains on the side of homebuilders. Yet, the jobs market and the general state of the economy will have an important bearing on the homebuilder stocks.

If you’re an ETF investor, and are being squeezed by inflation, I have just unveiled a new service, Joe Duarte’s Sector Selector, which is 100% ETF driven and priced for less than a latte’. You can check out the details here.

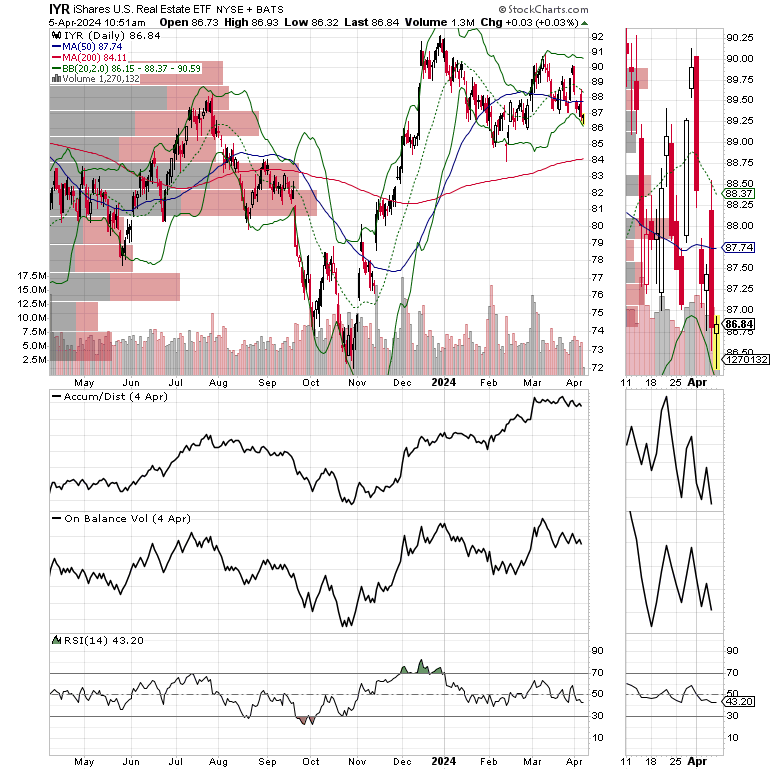

The realtor I spoke to may be onto something when it comes to the rental market. Apartment supply is rising and despite what the mainstream thinks, rents have likely topped out. That’s why home rental real estate investment trusts are underperforming the homebuilders.

The iShares U.S. Real Estate ETF (IYR) remains in a slightly bearish consolidation pattern and is not gaining much traction. Note the rolling over of the Accumulation/Distribution line (ADI) and the stalling of the On Balance Volume line (OBV). The action in the ADI indicates that short sellers are starting to build positions while the stalling in OBV suggests that buyers are starting to pull back.

Bottom Line

Bond traders are not pleased with the current employment data but are not totally freaked out by it either. Mortgage rates will likely test 7% if the U.S. Ten Year Note yield rises above 4.4%.

The emerging new normal can be summarized as one in which the Fed has stopped raising rates while the expectations of rate cuts are fading.

The homebuilder stocks are outperforming the home rental REITS. This could change if rates rise above 4.4% on TNX and 7% on the average 30-year mortgage.

Thanks to everyone at Substack for an amazing welcome and your ongoing and growing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. If you’re not a member, this is a great time to join the coffee club and receive Joe Duarte’s newly christened Sector Selector ETF service. A month’s subscription really costs less than a latte’.

For intermediate term stock and option trades, consider a subscription to Joe Duarte in the Money Options.com.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.