Letting Profits Ride after CPI Miss. New Trade Goes Live Plus Raising Sell Stops on All Existing Trades.

Market Rally Raises Odds of Potential $1400 Paycheck.

Our existing trades are acting well and our newly recommended trade went live this morning.

This morning’s, CPI came in better than expected, triggering a rally in both U.S. Treasury bonds and stocks, as I recently suggested was possible.

The salient points inside the report is that service prices, especially rents and grocery prices seem to be slowing, which if continued will ease future readings.

The bond market’s reaction, and whether it stays in place, is the most important aspect of the day’s trading action. That’s because the U.S. Ten Year Note yield (TNX) has broken below its 50-day moving average, and is trading below 4.4%. The next test for TNX is whether it can move below its 200-day moving average.

The best case scenario, however, is one in which TNX doesn’t fall too much further than current levels in the short term. A precipitous fall from here would likely lead to a short term rebound in rates and increase the stock market’s volatility.

For its part, the stock market has responded in kind. The New York Stock Exchange Advance Decline line (NYAD) has been moving steadily higher over the last week, correctly forecasting a continuation of the rally which has taken hold over the last few days.

NYAD is getting overbought as the RSI indicator is trading above 70 this morning, so it would be good if things slowed down some of the next few days.

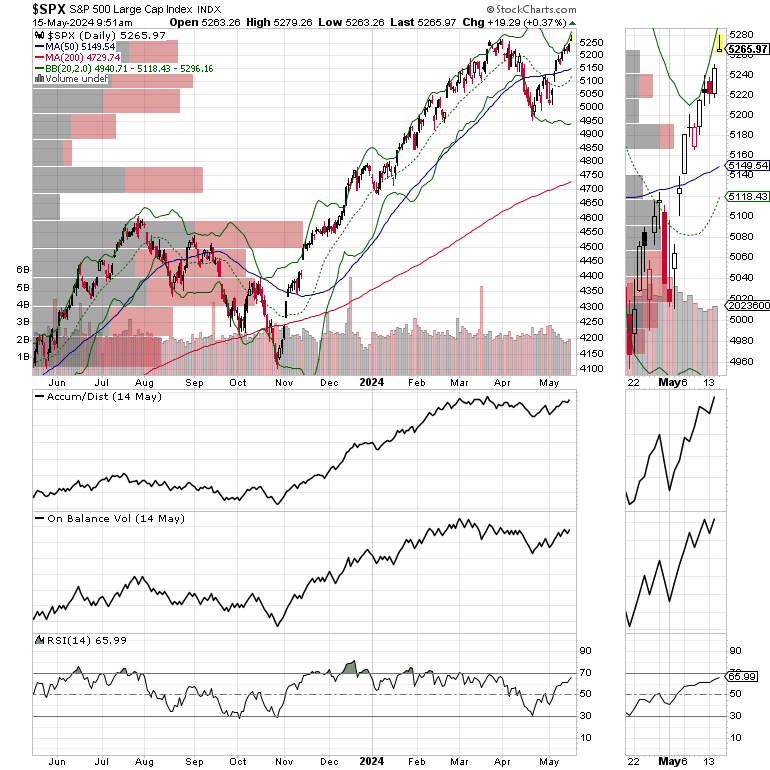

The New high on the S&P 500 (SPX) confirms the new high on NYAD, which means that the market is now in a new uptrend.

From a trading standpoint, yesterday’s new trade is now live while our existing trades continue to move nicely higher. I’ve adjusted the sell stops on the existing trades as appropriate and will be adding new trades as those stocks on my BUY List trigger their entry points.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.