Is the Deck Getting Stacked Against the Homebuilders?

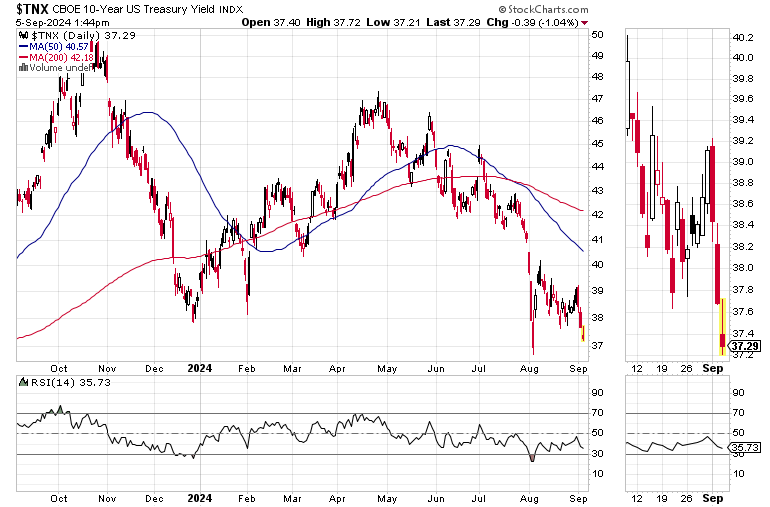

Crashing Bond Yields Reflect Bets on a Rapidly Slowing Economy.

The bond market seems to be betting on a weakening economy. Recent data suggests, they may be right. Tomorrow's payroll report is likely to be a market moving event.

The bond market is preparing for a weaker than expected employment report, with hopes rising for a Fed rate cut after the September 17-18 FOMC meeting. The question for investors and everyday people looking for a house, or to keep their job, is whether the rate cut, which seems highly likely as each day passes, and the data piles up, will be enough to ease some of the pressure that seems to be building in certain sectors of the economy.

The current situation is evolving rapidly, as the tight housing supply situation persists while it seems the jobs market is weakening. This may be a sign that the Fed is behind the curve and that we may see more aggressive rate cuts than expected.

Meanwhile, the money flows in the housing sector continue to shift with homebuilders holding their own while residential REITs continue to grow their business and their shares continue to rise. The reason why this change is occurring is simple. For many, owning a home is too expensive.

That’s not to say that homebuilders won’t remain profitable. But it does suggest that if interest rates don’t come down meaningfully, there may come a point where homebuilder profit margins begin to shrink.

Economic Data and Beige Book Confirm Retailer Concerns

This week's data suggests that at least some parts of the economy are slowing. For one, the manufacturing purchasing manager reports (ISM and S&P Global) showed a slowing of new orders and a continuation of higher prices at the wholesale level. Meanwhile, ISM and S&P Global non-manufacturing data suggests that the service sector remains stable.

Job openings data (JOLTS) missed expectations while the ADP private payrolls data also came in well below expectations. Both may be forecasting another weak Non-Farm Payrolls number this Friday. This morning’s ADP data

Combined, the data has increased the odds of the Fed cutting rates, unless, the jobs data suggests and the upcoming CPI and PPI suggest otherwise. The Bank of Canada just cut rates for the third time and says to expect more cuts.

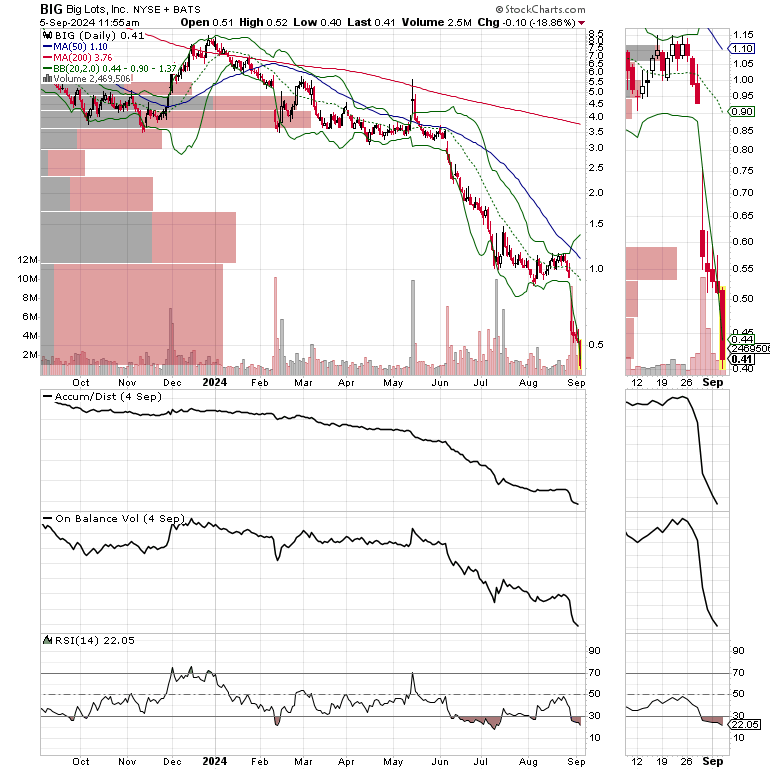

There are increasing signs of consumer stress as Dollar Tree (DLTR) missed it earnings; citing that its middle and upper income consumers, who've moved to their stores to avoid higher prices elsewhere are having troubles. Dollar Tree joined its competitor, Dollar General (DG) in reporting a rapidly slowing business climate, just as deep discounter Big Lots (LOTS) is being rumored to be nearing bankruptcy.

In addition, the Fed’s latest Beige Book reported that nine of the central bank’s districts reported flat or declining economic activity while only three reported what the central bank described as “slight” growth. Inside the report, in what could be a harbinger for Friday’s NFP data, the Fed noted that employment levels were “steady overall,” but that firms were starting to fill only essential positions, reducing hours, and using attrition to reduce head counts. The Fed also noted that consumer spending is slowing – confirming DLTR, DG, and BIG.

Drop in Mortgage Rates Isn’t Bringing Buyers into the Market Because the Jobs Market is Slowing and Housing Prices are Too High.

The homebuilders may have a problem if current trends continue. That’s because even though mortgage rates have dropped, they haven’t fallen enough to bring enough middle market customers in. Indeed, upscale publicly traded builders, such as Toll Brothers (TOL) have the upper hand, while publicly traded builders which cater to the middle and lower end of the markets are struggling along with small private builders.

The telltale sign of the current situation is that mortgage refinancing activity continues to beat mortgage activity for buying a home. This is borne out by this week’s mortgage data which shows that refinance demand is 94% higher than it was a year ago. Inside the report, two things stand out:

· Refinancing activity slowed week over week, but is higher year over year; and

· Activity for home buying mortgages rose 3% for the week, but remained 4% below last year. That demand was fueled mostly by FHA and VA loans which require lower down payments.

This is interesting as the odds of the Fed cutting rates are increasing. The Bank of Canada just cut rates for the third time and says to expect more cuts.

In addition, the Fed’s latest Beige Book reported that nine of the central bank’s districts reported flat or declining economic activity while only three reported what the central bank described as “slight” growth. Inside the report, in what could be a harbinger for Friday’s NFP data, the Fed noted that employment levels were “steady overall,” but that firms were starting to fill only essential positions, reducing hours, and using attrition to reduce head counts. The Fed also noted that consumer spending is slowing – confirming DLTR, DG, and BIG.

Bond Yields Threaten New Lows

The U.S. Ten Year Note yield (TNX) is hovering just above its December 2023 lows of 3.76%. A move below this level could take TNX to 3.5%. Bond yields at such low levels suggest that bond traders are increasingly concerned about the economy’s strength, and are increasingly betting on what could be a precipitous drop in inflation.

For their part, mortgage rates continue to hover near their recent lows with the odds favoring a continuation of the pattern if TNX doesn't reverse in response to the NFP report.

Structural Shift Toward Renting Continues as Costs Remain Too High and the Economy is Slowing

As I noted in my recent article, cited above, even though the supply and demand scenario favors homebuilders, in the current market, it’s all about the monthly payment, which means that many potential home buyers are opting to rent.

The iShares U.S. Home Construction ETF (ITB) remains in a consolidation pattern as investors wait for the next move in the bond market and from the Fed.

The iShares U.S. Real Estate ETF (IYR) is due for a pullback, but is clearly taking over the lead in the housing sector.

Bottom Line

The economy is weakening and persistently high housing prices are starting to weigh on the homebuilders as the potential for slowing home sales is increasing. If current trends continue, REITs focusing on rental housing are likely to grab market share from homebuilders.

Much depend on the developments in the labor market, what the Fed does and how the economy responds.

Heartfelt thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

Good thoughts. Though it's tough to see a real slowdown unfolding here unless we get a real spike in unemployment due to permanent layoffs rather than just an increase in the labor force.

It's all coming together ahead of the FOMC meeting. It's all a patchwork of differing and often shifting dynamics as Complexity hits overdrive. I'm just glad this isn't my first rodeo, or I'd be totally freaked out by all the things that are happening - seemingly all at once.