Fingers Crossed. PPI Offers Pleasant Surprise. CPI Looms.

$760 in Profits plus, a Stealthy Big Value Play on a Sold Out Diamond in the Rough

Image courtesy of istockphoto.com.

Stocks got a reprieve this morning as a better than expected Producer Price Index (PPI) report helped traders breathe an albeit temporary sigh of relief ahead of tomorrow’s CPI. Still, the market’s breadth is acting better than the major indexes, which could make things interesting if CPI delivers a negative surprise. Thus, it’s best to avoid major risk for now until we get the all clear. In other words:

• Stay patient;

• Stick with what’s working;

• Hold onto any position that is not stopped out. And most of all;

• Look for relative strength, building a shopping list and retooling portfolios for the next up trend.

In today’s ESP update, I offer a compelling value stock in an industry which is desperately oversold and has huge potential once bond yields ease.

SOLD, Kratos (KTOS) Call Option and Bristol Myers Squibb (BMY) for $760 Combined Profit.

This morning we’re taking some profits with a combined haul of $760.

First, our shares in pharmaceutical firm Bristol Myers Squibb (BMY) were stopped out with a $700 gain. We were also stopped out of our February 21, 2025 Kratos Defense & Security Solutions (KTOS) $30 Call Option which delivered a modest profit, which is a nice bonus especially in a tough market. Here are the details:

• SOLD Bristol Myers Squibb (BMY). Bought 9/20/24: $49. SOLD 1/14/25. Sell Stop: $56. Return for this trade: $700/100 shares (14.3%).

• CLOSED - February 21, 2025 Kratos Defense & Security Solutions (KTOS) $30 Call option. Bought 12/31/24: $0.82. Closed 1/07/25 intraday price: $1.45. Return for this trade: $63/100 shares (43.4%).

Market Update – CPI Looms. Fingers Crossed.

The New York Stock Exchange Advance Decline line (NYAD) is bouncing this morning after a quiet intraday reversal yesterday. I’ve been expecting this type of activity for the past several weeks as each new low in NYAD has not been confirmed by the RSI creating a positive breadth divergence, such as we saw in November 2023.

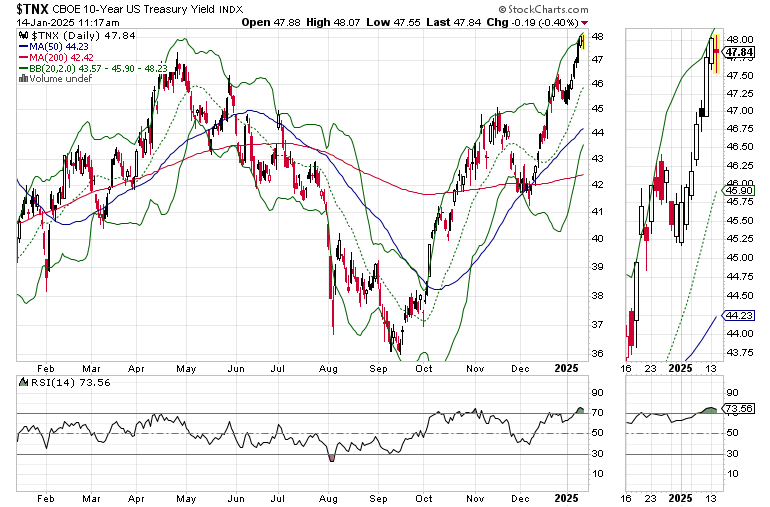

The U.S. Ten Year Note yield (TNX) is growing top heavy and may reverse as soon as the CPI number is released, unless the number shows that even though producer level inflation may be slowing, consumer inflation is not. It’s a tough call. And to be honest, given the expenses I’ve incurred lately, at the grocery store, at the Vet, and other places, I’m not expecting a big beat. But then, the government seems to live in a different world than the rest of us so we may get a good number. Fingers crossed.

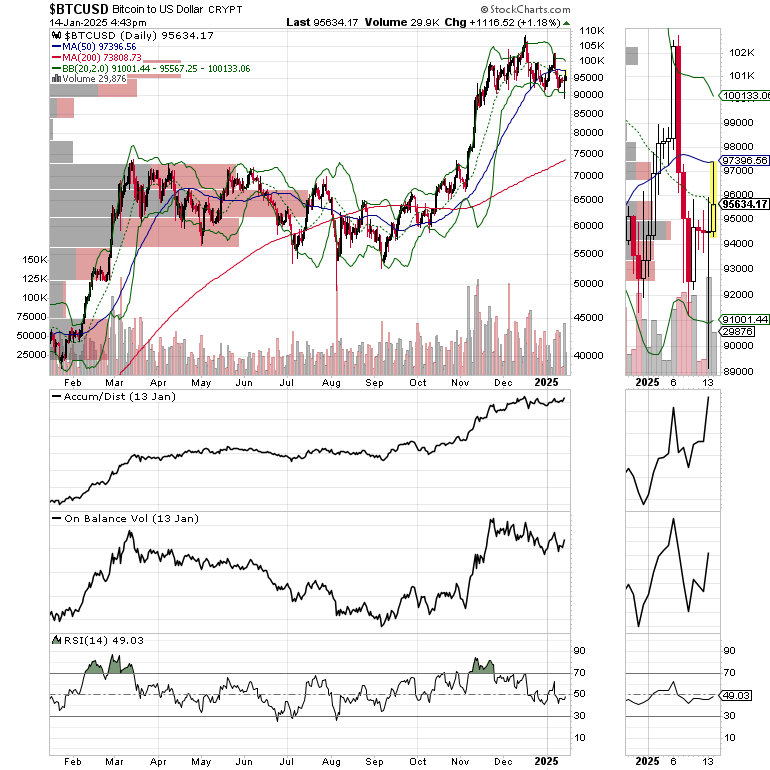

Bitcoin (BTC/USD) continues to hover between $90,000 and $100,000, but money seems to be trickling in. We’ll see what happens here as well.

The S&P 500 (SPX) gave back its early day gains as the $5900-$6000 resistance band remains challenging.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

If you’re a weekend investor, I’ve got just the thing for you. Check out my steady pace long term focused Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101 (https://shorturl.at/Ad0K7)

– will get you started along the right path.

If this market is stressing you out please visit our Health Page.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.