Extended Stay Portfolio Update – Fear is Back. Plus, a New Bottom Fishing Trade.

Anxiety can be a prelude to a buying opportunity.

It’s not extreme fear but the CNN Greed/Fear Index fell to 39 on yesterday’s tech selloff. What’s left is a great deal of anxiety and handwringing. Eventually, this may turn into a buying opportunity. Already, some of the tech stocks are showing signs of life. And although caution is warranted, I’ve added a new bottom fishing tech trade to the ESP portfolio this morning.

Image courtesy of https://eddinscounseling.com.

Of course, the DeepSeek saga will continue to unfold and each day will bring new information which is likely to move the markets. That means that volatility in the AI related areas technology may not subside for a while. From a trading standpoint, all we can do is observe what the big money is doing. Right now, it’s a bit early to tell. I expect that over the next week or two, money flows will be able to give us enough clues as to what’s next. Right now, the non AI areas of the market look much more interesting.

We’ve been digging into some of these areas in the Weekender Portfolio with encouraging results.

Market Update

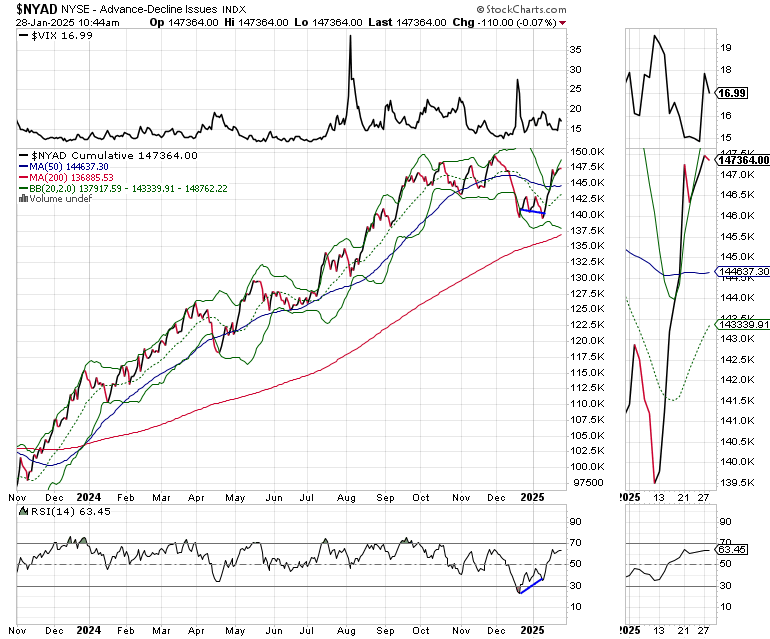

The New York Stock Exchange Advance Decline line (NYAD) slept through the tech wreck, which is very encouraging as it signals that most of the market is still in an uptrend. We should watch this carefully, but right now it’s a positive.

The U.S. Ten Year Note yield (TNX) is still below 4.6%, which is also encouraging. The RSI is hovering near 50 which suggests we might see another rebound. This would be more likely if the Fed remains hawkish and Mr. Powell’s press conference goes south, as it sometimes can.

Our ESP portfolio remains well positioned with its holdings preserving their recent uptrends. Once the Fed does whatever it’s going to do and the market responds I’ll have a better idea as to when to deploy potential picks from my shopping list.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership. Two new trades were posted yesterday.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

Trading is stressful and can drag you down. You can feel better if you take the right supplements. Check out our health page.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.