ESP Tuesday: Stock Market Steadies and a New ESP Pick.

So far, the trading pattern is mirroring the action in March-April 2020.

Stocks are trading in a steadier pattern with decreased volatility leading to smaller intraday ranges. That’s a good thing, which of course, could change at any moment due to any tariff or related headlines. Much of the worrying is now about the bond market where the rumors about the Chinese selling U.S. Treasuries to prop up their currency (the yuan) are rising in intensity.

Image courtesy of dissolve.com

That said, as I recently noted it’s a good time to review what happened the last time we saw a similar market, March-April 2020. That’s when the S&P 500 (SPX) fell to its lower Bollinger Band four standard deviations below the 200-day moving average (4SD, purple line), as we saw on April 5, 6, and 7 of this year. This is a rare but meaningful event, which marks a very oversold market.

What we saw after the last 4SD tag was a significant market turn around and a rally whose first leg lasted until October 2022. Of course much of that was due to the Fed’s nuclear QE, which has yet to materialize this time, although the central bank is starting to hint that it would do something meaningful if things got worse.

So, where are we? So far, the market is following the March-April 2020 script. Maybe the Fed will join the party.

Market Update

The S&P 500 (SPX) has bottomed out and is having some trouble getting above the first meaningful resistance level of 5450. Once it gets past that, expect a test of the 200-day moving average.

The New York Stock Exchange Advance Decline line (NYAD) is back inside its accompanying 2SD Bollinger Bands, which is a positive development after it hit an oversold reading of 30 on the RSI. A move above the 200-day moving average would be a big positive.

The New York Stock Exchange Advance Decline line (NYAD) has also bottomed out and faces a test of resistance at its 200-day moving average as well. The CBOE Volatility Index (VIX) has also declined, which is a positive development.

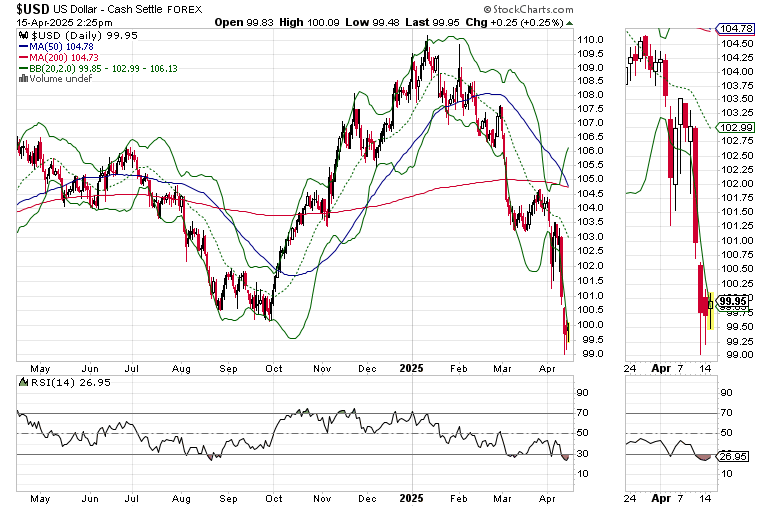

The U.S. Dollar continues to struggle. USD is now testing important, long term support is at the $100 area for the U.S. Dollar Index. It is oversold and should bounce. However, a failure here would likely have some major repercussions throughout the financial markets.

The U.S. Ten Year Note yield (TNX) is testing its 200-day moving average, suggesting that bond traders are less convinced of a recession now.

This morning, I am adding a new trade in a stock which has rebounded quite well after the recent market wide selling spree. This rebound suggests that investors are picking up right where they left off before the tariff drama hit fever pitch. I am also recommending taking some profits on a stock which has delivered a $1000-plus gain in a week. It has more to go, but in this market taking some profits is an excellent idea.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For large potential profits with longer term holding periods in stocks check out the Smart Money Passport Weekender Portfolio.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

SPECIAL PROMOTION! - In this market you’ve got to stay healthy and alert. Grab some great clean energy and vitality products and get your edge back on our health page. As a special bonus, you will receive a Free one month subscription to the Weekender portfolio with your first health purchase.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.