ESP Tuesday: Nursing the pre-Holiday Hangover. Hedging But Looking to Buy Bitcoin in Dip. New Trade on Tap.

Tomorrow's PCE number should be interesting.

All parties lead to hangovers. And today is no different.

So, Wall Street is nursing a bit of a pre-Thanksgiving hangover after yesterday’s big day while the Bitcoin rally takes a breather. As a result, I’ve put on a hedge on our Bitcoin trade. I am nowhere near bearish on Bitcoin, and I suspect we will be buying on a dip at some point when things calm down.

This hangover could easily lift if tomorrow’s PCE inflation number comes in good enough to keep the bond market from rekindling its upward trend.

Image courtesy of https://cdn-prod.medicalnewstoday.com/

Our Extended Stay (ESP) portfolio remains in solid shape with all eight distinct positions holding their own. I am also adding a new very contrarian housing related pick to the mix.

Market Update

The major indexes are mixed this morning. The New York Stock Exchange Advance Decline line (NYAD) is holding above yesterday’s breakout, which is comforting. We want NYAD to hold up and move steadily higher.

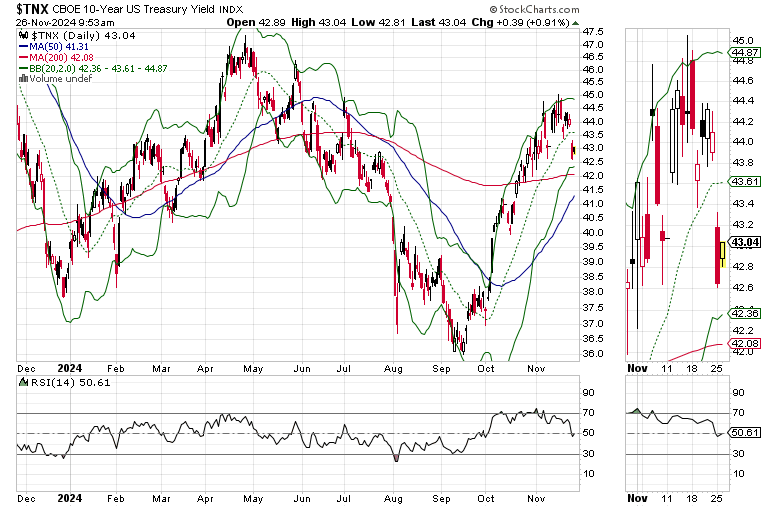

The U.S. Ten Year Note yield (TNX) is hugging the critical 4.3% yield area after yesterday’s break below the key chart point. A sustained move below 4.3% will trigger a test of 4.2% and the 200-day moving average. A sustained move below 4.2% would be bullish for stocks.

Bitcoin is pulling back after being overbought for the last few weeks (RSI above 70). I am hedged on Bitcoin right now, but remain bullish longer term. You can see the details on the hedge in the paid portion of this post.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101

– will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.