Double Breakout on a Freaky Friday – Bond Yields Test 4% as Homebuilders Extend their Breakout

The U.S. Ten Year Note yield is on its way to a test of the 4% yield and the homebuilder stocks are extending their breakout as the Fed says they’re encouraged by the progress they’ve made on inflation.

The stock market rally, which I’ve remained nervously engaged with for the past few weeks continues to unfold. This morning’s “better than expected” jobs data did not trigger a rise in bond yields. In fact, after the numbers were released the U.S. Ten Year Note yield (TNX) ticked lower and seems headed for a test of the 4% area. A move below that will likely trigger an extension of the rally in stocks, at least in the short term.

Much of the bullish response in bonds seem to lie with the rise in the unemployment rate and the now routine downward revisions of the monthly payrolls. But setting the background for a bullish response from the bond market was Fed Chairman Powell’s dovish remarks before congress about the central bank getting closer to rate cuts.

Yields Fall. Mortgages Likely to Drop Further.

The U.S. Ten Year Note (TNX) remains in a bullish downtrend having crossed below its 50 and 200-day moving averages, likely triggering algo trading programs in both stocks and bonds.

In addition, it’s reasonable to expect a further drop in mortgage rates as the average 30-year rate has also turned lower after a brief rise above its 50-day moving average.

Homebuilders Extend Breakout

As I’ve been expecting, the homebuilder sector has rallied in response to the fall in bond yields and is extending its breakout, although a pause is likely in the short term.

The S&P SPDR Homebuilders ETF (XHB) continues to climb steadily and is well entrenched in what looks to be a momentum run. Until proven otherwise, and until bond yields reverse, pullbacks in XHB may be worth considering as dip-buying opportunities.

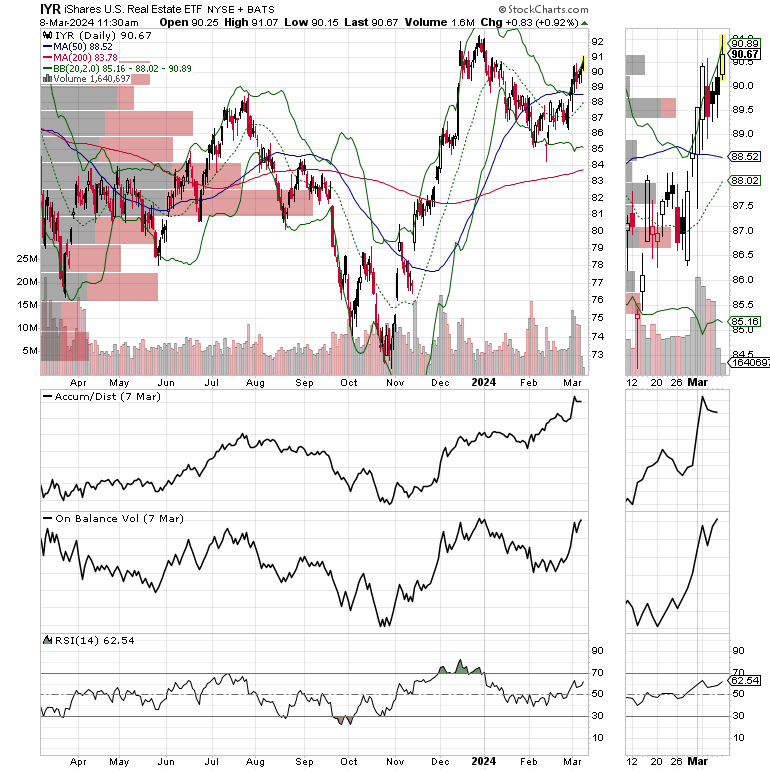

REITs Perk Up

Interestingly, the real estate investment trusts (REITs), especially those in the home rental side of the business have perked up pushing the iShares U.S. Real Estate ETF (IYR) higher. IYR could move decidedly higher if it takes out the $92 resistance area.

Both ADI and OBV are very constructive here. There is good support at the 50-day moving average.

Bottom Line

Bond yields hold the key to what happens in the stock market over the next few days to weeks. The action in the homebuilders and the REITs is encouraging. Of the two sectors, the REITS are less overbought and may be worth considering.

Thanks to everyone for their ongoing support. I really appreciate it.

I’ve recently added a new real estate related pick with huge upside potential and have updated the homebuilders held in the Joe Duarte in the Money Options model portfolios. You can check them all out with a Free Two Week Trial to the Service.

If you like this report and want access to timely, easy to digest content which complements the Buy and Sell recommendations offered at Joe Duarte in the Money Options.com, consider becoming a Buy Me a Coffee member.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.