DeepSeek and Tariffs Unsettle Markets. Brace for Wall Street Talk of Soft Landings, Goldilocks, and Trade Wars.

How many more bullets can the stock market dodge?

Goldilocks Image courtesy of buzzfeed.com

The Wall Street sell side sales machine is adept at using catchphrases through which they can push stocks on the masses. Two of their favorites are “soft landing” and “Goldilocks economy.” A third one is “trade war.” Get ready to hear them all often in the near to intermediate term. Meanwhile, bearish sentiment is rising rapidly. Expect more volatility.

DeepSeek, Tariffs, Confusion and Volatility. How Many More Bullets Can the Stock Market Dodge?

Stocks resemble a moving target in a scary war zone. Last week was a bumpy ride as the news of the newly developed DeepSeek AI program – made in China – shook up the calculus in the AI sector. Wall Street’s initial reaction was that U.S. companies were spending too much money on AI and that they were about to lose the so called “AI war” against Chinese competition. They may be right; or not. But they sold hard, and then they started nibbling. It’s hard to know how DeepSeek will evolve.

On Friday, the U.S. announced 25% tariffs on goods from Canada and Mexico, along with the 10% tariffs announced on China; activated on 2/1/25. Canada is talking tough. Mexico is taking a “wait and see approach.” China has been quiet.

I’ve recently voiced my expectations of something big brewing under the market’s surface as I detailed here, although my concerns about Chaos exerting a big influence on markets started back in October. The short version was that with the Federal Reserve not likely to lower rates at its January meeting (which was correct), the market was vulnerable to a potential “Black Swan” event. And of course, Chaos was more than happy to oblige via the Deep Seek and tariff announcements. Both matter because the stock market’s performance hinges on what the bond market thinks about inflation. Thus, a retracement of the recent bond rally would likely hit stocks.

Prior to the confirmation that tariffs would hit on February 1, bond traders were downright giddy after Mr. Powell, in his 1/29/25 press conference made it clear that the FOMC is in no hurry to lower rates given the current rate of inflation.

The costliest item in CPI of late has been shelter. Yet, as James Foord of the Pragmatic Investor recently showed here, rents have been quietly falling for some time, but have yet to register in CPI due way the data is compiled. Thus, it could be just a matter of time before lower rents make it to CPI. Meanwhile, the most recent PCE came in as expected but is still showing signs of inflation grinding higher while GDP came in below expectations at 2.3% YOY growth.

All of which brings me to Goldilocks – an economy that is growing steadily with moderate inflation. We don’t have that just yet, but it can be preceded by a “soft landing” where the Fed slows inflation but keeps the economy going. The only soft landing in recent history was engineered by Alan Greenspan in 1994. If Powell comes close to repeating the feat, he will make up for his previous errors regarding inflation, such as calling it “transitory” in 2020.

Wall Street was setting itself up for a soft landing before the tariff news hit. Let’s see what the January employment report tells us.

Inside the Market – It Could Go Either Way.

Here is what our favorite group of indicators are telling us:

• The CNN Greed/Fear Index (GF) is at 46, bordering on fear. This may be a positive if it keeps falling. It registering a bullish reading of 27 right before market bottomed.

• The Put/Call ratio rallied to 0.85 after recently falling below 0.7. The recent high was just above 1.0 in early 2025. The prior meaningful market bottoms, which led to long term rallies followed P/C ratios of 1.25 (8/24) and 1.30 (11/24). A sudden peak in this indicator could again signal a market bottom.

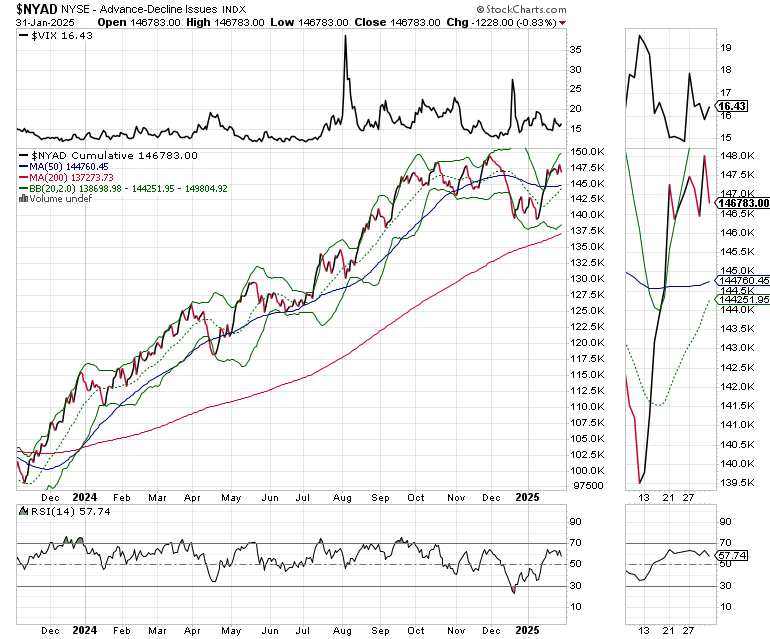

• The New York Stock Exchange Advance Decline line (NYAD, is still looking to make that elusive new high, but is holding up.

Bottom line: Bearish sentiment is on the rise. The bond market is not crashing. Let’s see if things hold up.

Bond Market Bulls Bet on Soft Landing. Tariffs Add Wrinkle.

The bond market liked the Fed’s interest rate pause, but reversed rapidly on the tariff announcement.

The U.S. Ten Year Note yield (TNX) closed last week just below the 4.6% yield but could easily rise in the short term and test its recent highs. A decisive move below 4.5% would be a sign that inflationary expectations are receding and should be bullish for stocks.

Three Potential Goldilocks Sectors: Healthcare, Restaurants, and Housing.

If the Goldilocks scenario unfolds, keep an eye on these three groups.

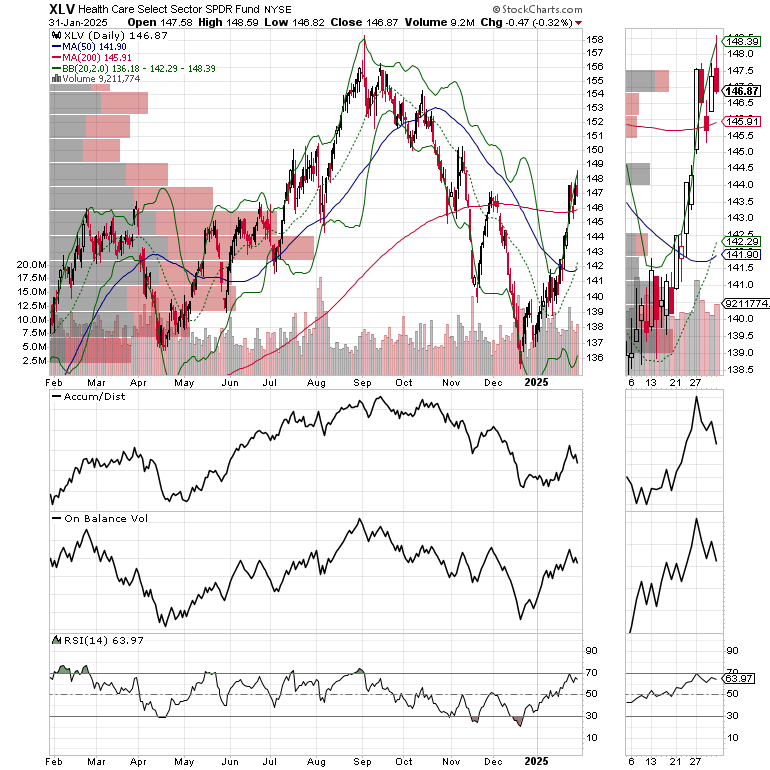

The Healthcare Select Sector SPDR Fund (XLV) is testing its 200 day moving average, possibly setting up for what could be a sizeable move up from current levels. We’ve been moving some money into some healthcare stocks at the Smart Money Passport.

A second area of the market worth watching is the small stocks. The iShares Core S&P Small-Cap ETF (IJR) is also testing its 200-day moving average. We have been nibbling at small stocks in the Weekender Portfolio.

The housing sector is also worth watching. We’ve seen better than expected earnings from PulteGroup (PHM), Lennar (LEN) and D.R. Horton (DHI) in the last few weeks, while Beazer (BZH) recently missed badly. The action in the bond market will directly affect the homebuilders which remain very out of favor. I’ve been cautiously adding housing stocks cautiously to both my long term focused Weekender Portfolio, and the more aggressive short term oriented Smart Money Passport lately. For ETF trades, check out the Sector Selector portfolio.

Liquidity Creeps Higher

Liquidity, the ease with which money travels through the financial system is the key to bull and bear markets. When liquidity is ample, markets tend to rise. When liquidity is scarce markets don’t do well. The Federal Reserve’s National Financial Conditions Index (NFCI) is a readily available tool which indirectly shows us the state of liquidity in the markets.

A decline in the weekly NFCI number indicates that the ease with which money can be borrowed is rising. Last week, NFCI again moved slightly lower. This remains a positive for stocks.

Bitcoin Remains in Volatile Trading Range

Bitcoin (BTCUSD) remains rangebound and within reach of a major breakout with the $100,000 level and the 50-day moving average becoming a reliable dip buying point. $107-$109,000 remain stubborn resistance.

You can check out my latest Bitcoin trade at the Smart Money Passport. If you’re an ETF trader, consider, Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about starting a day trading career, my new book “Day Trading 101” will get you started on the right foot. For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. And if you’re looking cut your stress and trade more effectively, visit my Health Page.

NYAD Reverses After Approaching New Highs

The New York Stock Exchange Advance Decline line (NYAD) remains within reach of a new high but failed to deliver last week. RSI is turning lower, suggesting a loss of momentum. The 50-day moving average is a critical support level.

Insert NYAD>The Nasdaq 100 Index (NDX) is still struggling to close above 22,000. ADI and OBV seem to be softening as profit taking takes over in the short term. The 50-day MA is important support.

The S&P 500 (SPX) remained above the 6000 level, which along with the 50-day moving average is important support. Volume seems to be shifting toward the sellers.

VIX Remains Below 20

The CBOE Volatility Index (VIX), remains below 20. This is constructive.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 Best Seller in Options Trading – Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

4.5 out of 5 stars

#1 Best Seller in Options Trading