This morning’s CPI came in hotter than expected and bond yields moved decidedly higher pushing stocks lower. In addition, expectations for a June rate cut from the Federal Reserve are now almost nil.

The real question for investors is whether this decline will set up a buying opportunity over the next few days to weeks.

Inside CPI

The numbers came in above expectations at all levels. The month to month rate was up 0.4% (0.3% expected) with the year over year clocking in at 3.5% versus 3.4% expected. Core CPI (ex-food and energy) mirrored the month to month rate at 0.4% (0.3%) expected.

Inside the report, costs for energy, shelter, and car insurance were the biggest contributors to the increase.

Bond Yields Break Out. Stocks Test Support.

The U.S. Ten Year Note yield (TNX) initially moved above 4.5% but backed off as the day progressed. Still, the move takes yields above the 4/9/24 close (4.362%) by a wide margin and sets up the 4.4% level as the new support level to watch.

The reversal in bonds triggered heavy selling in the stock market. The New York Stock Exchange Advance Decline line (NYAD) broke below short term support at its 20-day moving average while the CBOE Volatility Index (VIX) rose above 16, a level it hasn’t seen since October 2023.

The S&P 500 (SPX) fell below is 20-day moving average and looks set to test the 5100 level and its 50-day moving average.

The Nasdaq 100 Index (NDX) is testing the 18,000 area and its 50-day moving average.

Energy, and Semiconductors Hold Up.

Two groups showed significant relative strength, energy and surprisingly the semiconductor stocks.

The Oil Index (XOI) held near its recent highs as the situation in the Middle East remains uncertain and oil supply data from the U.S. Energy Information Agency (EIA) will be out this morning.

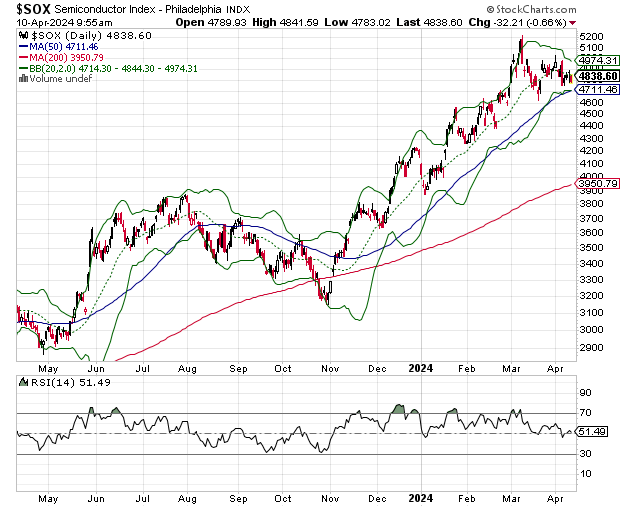

The Philadelphia Semiconductor Index (SOX) showed some relative calm trading above its 50-day moving average.

Homebuilders Take a Pounding

The S&P Homebuilding Subindustry Index (SPHB) fell in response to higher bond yields and the expectation of higher mortgage rates. Support is at the 50-day moving average.

Is All Lost?

The initial reaction to the worse than expected CPI numbers is understandable. The market is now pricing in the reality that the Fed won’t be raising rates in June. It is now plausible, although not certain by any means, that the Fed won’t be raising rates this year.

At the same time, on the ground supply and demand will tell the tale of what happens in the market. As earnings season unfolds, we’ll see results and hear from company managements about conditions and the future of sales.

After it’s all said and done, the odds are at least even that this selloff may be yet another opportunity to buy stocks in sectors where the supply and demand is in favor of companies in key areas of the economy.

Consider these factors:

The AI trend remains in place;

Supply and demand remain in favor of homebuilders; and

The energy equation is nowhere near being solved.

Bottom Line

The nasty CPI surprise is only the beginning of what happens next. The market will adjust accordingly based on supply and demand for goods and services.

Inside the CPI, there was a decline in cost for goods and materials. The rise in the index was due to services. What that says is that consumers and businesses have adjusted their purchase patterns for goods with prices falling. If the market acts accordingly, then we are likely to see a decline in demand for services which will eventually cool off service prices.

The Fed won’t be cutting rates anytime soon. Higher rates will continue to pressure consumer behavior.

Rather than panic, our best bet is to watch what the market does in the next couple of days. When it comes to individual holdings, stick to the following principles:

· Expect an Increase in Volatility.

· Stick with what’s working; if a position is holding up – keep it;

· Take profits in overextended sectors;

· Consider some short term hedges;

· Look for value in out of favor areas of the market;

· Protect your gains with sell stops. Raise them as prices of your holdings rise; and

· Trade one day at a time.

More as needed.