Contrarian Alert - Buying the Dip on Homebuilders as Bond Rout is Closer to Ending than Beginning

Bond yields may be on the cusp of a surprising reversal.

Sometimes, when investing, it makes sense to look over the precipice and face your fears. This may be one of those times. Yet, as we peer over the abyss, it’s always prudent to have a parachute strapped on your back.

Cautiously Contrarian

I’ve said it before, but it’s worth repeating: It’s always darkest before the dawn. So, against all my fight and flight instincts I’ve strapped my contrarian boots on, while acknowledging that I may be early or wrong and keeping my parachute strapped on tightly.

To be clear. I’ve been adding to my positions in the homebuilders lately, but only in small lots and only on dip reversals.

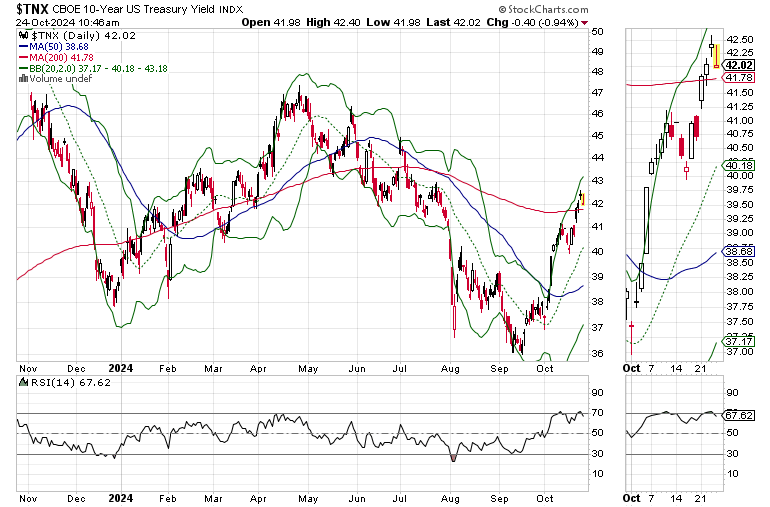

I know, the winds are pretty strong at this altitude and the air is pretty thin. The U.S. Ten Year Note yield (TNX) continues to climb daily and the stock market is totally freaked out. Yet, one of the cardinal rules of commodity investing is that supply is the key to prices. And in the housing market, which is as pure a commodity market as there is, supplies are scarce and the homebuilders seem to be in charge.

Supply is the Key to All Markets

The supply side of the housing market has three components, new homes, existing homes, and homes for rent (single and multifamily). When all three segments are oversupplied prices fall. In the current market, there is an oversupply of multifamily homes for rent with a scarcity of existing homes for sale. That leaves single family rentals and new homes for purchase to supply the demand.

That’s a tight market that favors homebuilders and to a lesser degree a select portion of the rental market. The numbers add up as the most recent existing home sales data fell to the lowest level since 2010 while new home sales beat expectations.

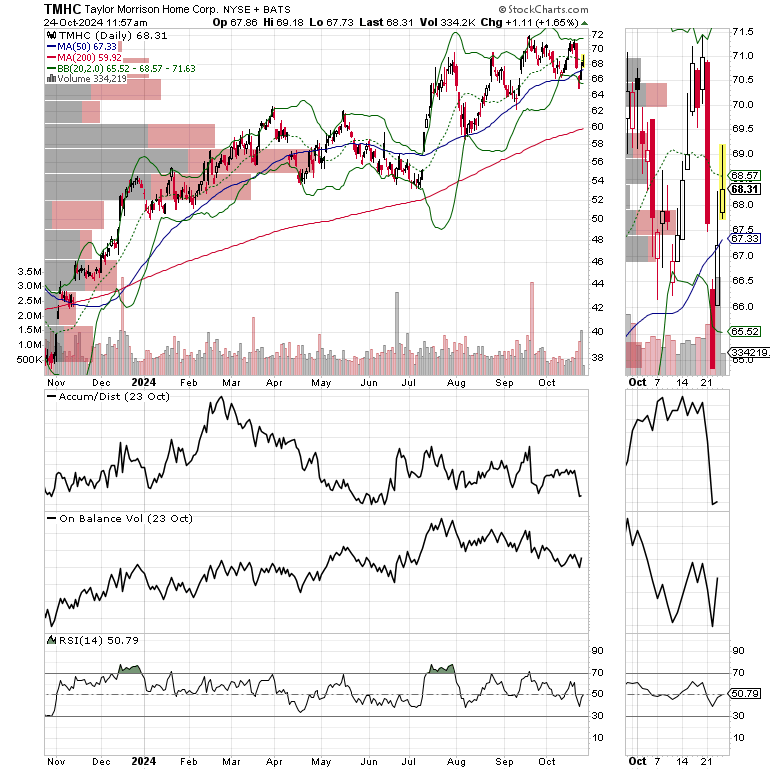

In contrast, both Taylor Morrison (THMC) and Toll Brothers (TOL) both of which I own shares in reported better than expected earnings while giving upbeat guidance with some reservations. I will focus on Taylor Morrison’s earnings call because it’s quite representative of the current market. Kudos to CEO Sheryl Palmer and team for a no B.S. earnings call.

Here are the salient facts from THMC’s conference call:

· TMHC beat both revenues and earnings expectations while delivering gross margins of 23.9%;

· Sales increased by 25% year over year

· The most active segment of sales was for spec homes (55% of sales) which suggests a certain urgency on the part of buyers who were trying to get in on lower mortgage rates;

· Built to order sales comprised 45% of the total with entry level purchases accounting for 35% of sales and resort style (upscale homes) accounting for 22% of all sales;

· Demand for entry level and move up homes remains high and is expected to grow. These segments require more incentives to move buyers to close.

It all add up to homebuilders retaining the upper hand in this market.

Note the bullish consolidation pattern in TMHC. I expect that once we see a top in bond yields, the homebuilder stocks, including TMHC should break out of the current trading range.

Bond Yields May Near a Significant Top

The rise in bond yields is nearing a potential reversal, and this morning’s action is a good start. The consequences may be bullish in the short to intermediate term for all stocks, especially homebuilders and REITs.

The U.S. Ten Year Note yield (TNX) may be topping out in the short term. Yet a decisive reversal would require a move below 4% and the 200-day moving average.

Mortgage rates remain high, but will reverse once TNX rolls over.

On the Ground – Stark Differences Based on Price Points

Construction continues to develop in upscale communities, confirming TMHC CEO Sheryl Palmer’s on point remarks, cited above.

That undeveloped subdivision owned by a small builder I’ve been keeping an eye on is sporting a “new construction” sign from a realtor, but there is no sign of new construction. Again, this community is targeting the upper middle market in contrast to a gated community by a lake which has several new starts.

Renters should have some bargaining power in the next few weeks to months, as there is little movement in quality existing homes with much of the homes currently on the market requiring some repairs.

There are several apartment complexes which are on the verge of completion in my area. Some just hung up “Now Leasing” signs. I’m starting to see cars line up by the leasing office, but not much action yet.

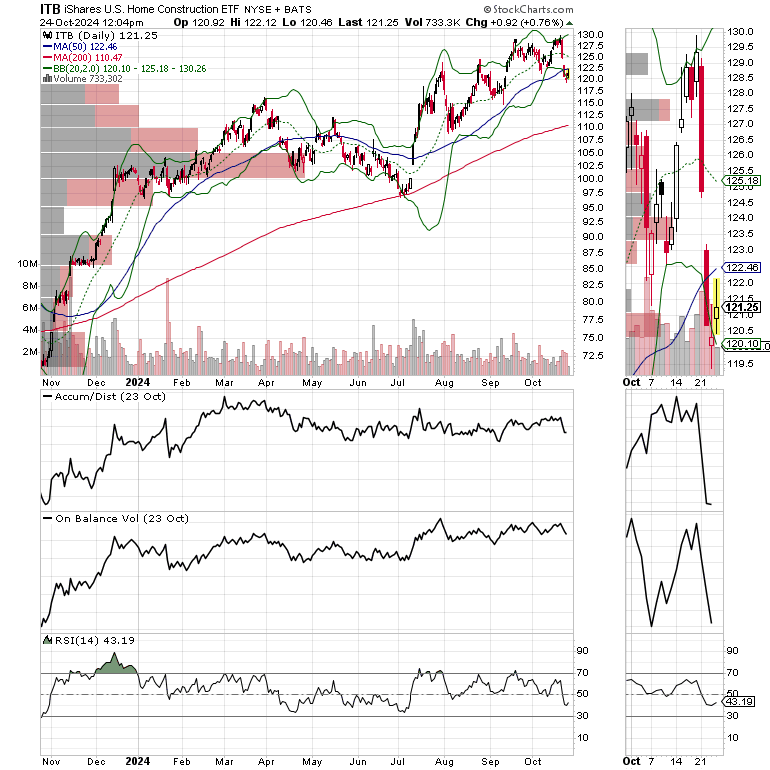

Homebuilders and REITs – Big Moves are Setting Up.

The iShares U.S. Home Construction ETF (ITB) held at the bottom of its recent trading range and should benefit from any drop in bond yields.

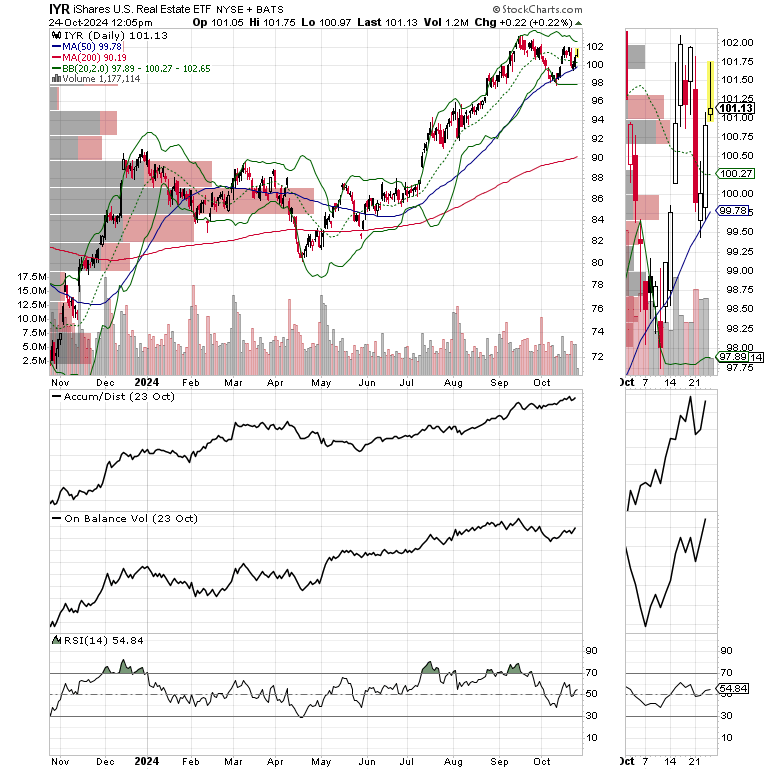

REITs Recover After Existing Home Sales

The worse than expected existing home sales had a positive effect on the real estate investment trusts (REITs) as the lack of activity in that segment of the housing market is likely to move potential home buyers into renting.

This is not a surprise. As I’ve noted over the last few months, in the current housing market, it’s all about the monthly payment. Moreover, as TMHC CEO Sheryl Palmer noted above, the entry level segment is challenging for homebuilders as younger home seekers are struggling to purchase homes. And while some can be persuaded by homebuilders, such as TMHC, others will opt for renting. And with an ample supply of apartments coming online, it’s likely that many of them will decide to go that route.

The iShares U.S. Real Estate ETF (IYR) recently found support at its 50-day moving average and the ADI and OBV lines are turning up as money moves back into the ETF.

Bottom Line

There is little change in the structural tightness in the housing sector. Supply and demand remain in favor of homebuilders. Potential home buyers are likely to focus on new homes with increased periods of activity likely when interest rates are favorable.

Until the macro environment changes, it makes sense to cautiously add to homebuilder and REIT positions on dips with the understanding that one may be wrong and that the market may test our patience.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

For long term trades featuring homebuilders and REITs go to Joe Duarte in the Money Options.com.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 – will get you started along the right path.

If you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.