Chip Stocks Grab a Bid. Plus, Two New Momentum Trades with Huge Upside Potential.

Big Week has great potential if favorable data comes in.

There’s a bullish bid under the semiconductors this morning.

This morning’s economic data suggests a slowing but steady path as both S&P Global and ISM Manufacturing data came in fairly sedate. A bright note was the lower than expected ISM Manufacturing prices which came in well below expectations.

The big number of the week, of course, is this week’s non-farm payrolls due out on Friday. We’ll get private jobs data (ADP) and the job openings data (JOLTS) ahead of that. Meanwhile there are several Fed speakers on the docket this week.

Image courtesy of freepik.com/

Market Update – Waiting for What’s Next as Chips Rebound

The New York Stock Exchange Advance Decline line (NYAD) is pulling back after last week’s new high. Momentum remains to the up side although the RSI is rolling over. The 20 and 50-day moving averages are still reliable support.

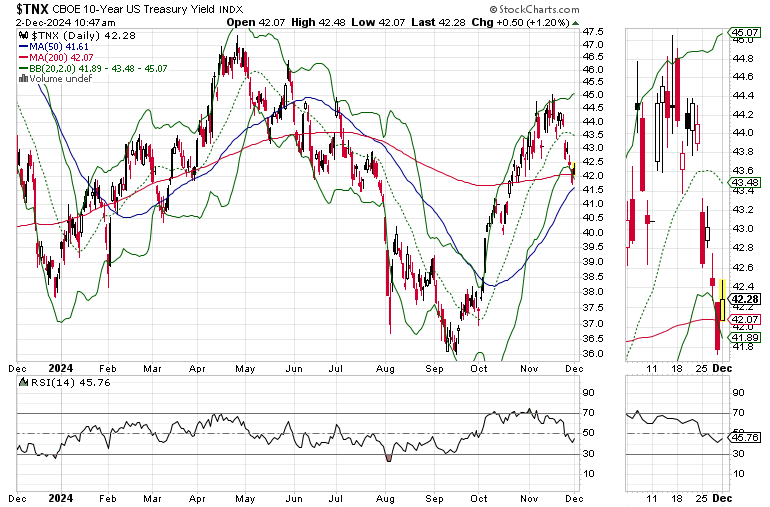

The U.S. Ten Year Note yield (TNX), is also taking a breather this morning as traders await the jobs data. Regular readers are aware of the fact that I’ve been expecting a retracement in TNX to the 200-day moving average, which is where we are this morning. A break below this key support level would be a major game changer, which would likely be bullish for stocks over the next few weeks.

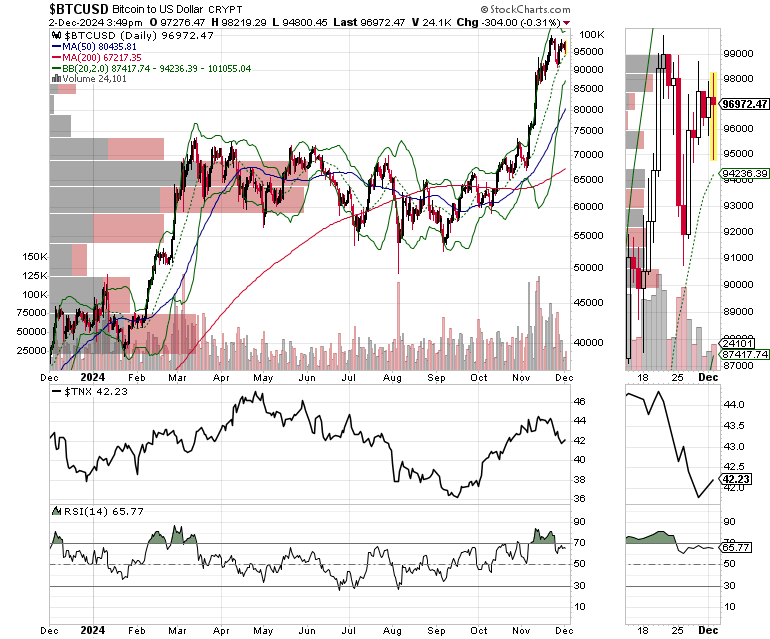

Bitcoin (BTC) looks set to make a big move as prices are trading in a tight pattern with the Bollinger Bands closing in.

This morning I am adding two trades. One is an under the radar small company with a bullish price chart and the other is a tech stock which could regain its recently lost luster.

The VanEck Vector Semiconductor ETF (SMH) is testing the key resistance of its 50-day moving average after finding support at its 200-day line.

Thanks to everyone for your support.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, included, at no extra charge with your Buy Me a Coffee membership.

For active trading, short term trading strategies, check out the Smart Money Passport.

If you’re looking for a slower pace to profits check out Joe’s Weekender Portfolio.

I also appreciate single coffees, which you can buy me here.

If you’re thinking about day trading, my new book – Day Trading 101 will get you started along the right path.

And if you like this post, hit the Like Button and Share/Restack it. It helps to spread the word.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.