Chalk One Up for Liquidity for Now. New Trade Revealed. Plus Momentum Portfolio Update.

The Fed and the PBOC's recent actions seem to be keeping traders calm for now.

The stock market’s response to the ongoing developments in the Middle East have, so far, been muted. Thus, for now, liquidity is winning the battle over uncertainty.

As I described in this weekend’s Smart Money Trading Strategy Weekly, this week promises to be volatile given the unfolding situation in the Middle East, as well as the upcoming employment data (ADP, JOLTS, NFP). On the other hand, China’s liquidity “bazooka” combined with the Fed’s recent rate cut (and promises for more) seem to be keeping stock traders from losing their patience.

In addition, there is the threat of an East and Gulf coast port strikes, and its effects on the supply chain. The latest reports suggest that the strike will begin on 10/1/24. So far, there are no signs that talks between the unions and the ports are about to restart.

Markets Are Surprisingly Quiet

Perhaps the biggest surprise is the relative quiet in the markets. Neither stock prices, or bond yields have made sizeable moves as of mid-morning.

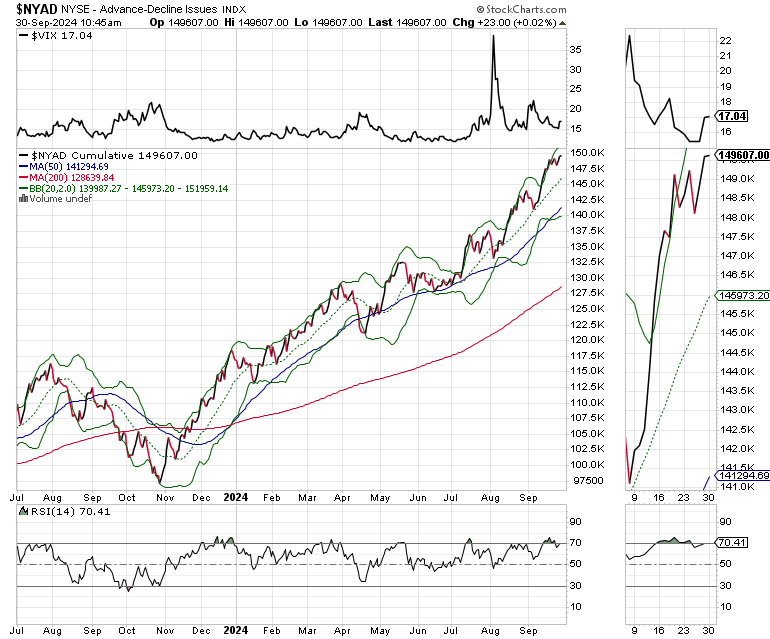

The New York Stock Exchange Advance Decline line (NYAD) started the day on the weak side but has recovered as the few traders who may have panicked and sold on the headlines have been replaced by dip buyers. There are no bear markets when NYAD is making new highs on a regular basis.

The U.S. Ten Year Note yield (TNX) maintains a short term upward bias but has not broken above its 50-day moving average or the more defining 3.9% yield. Bond traders will likely respond to Friday’s employment report with some energy, depending on what the data shows.

Momentum Portfolio Update

This edition of the Smart Money Passport is all about our Momentum Portfolio, which currently has three open trades which are holding their own nicely. One of them is slowly breaking out while the other two are on the cusp of breaking out. I am also adding a new trade today.

Tomorrow, I will have my weekly update on the Extended Stay Portfolio, where the open positions are also acting quite well.

This is a great opportunity to advance your subscription from Free to Paid so you can capture the potential gains from both the steadily blossoming Momentum Portfolio and the Extended Stay Portfolio trades.

Thank you all for your support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership. New Sector Selector Trade to be unveiled today.

For intermediate and long term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading and intermediate term strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.