Caution and Volatility are Back in Vogue. Plus, a New Conditional Momentum Trade

Stay patient. Be disciplined. Build the shopping list.

The political developments over the last few days have increased the market’s volatility, which means it’s time to be cautious, while still focusing on what’s working. That means tightening sell stops, and using strict entry points for stocks with bullish chart patterns, reliable performance, and strong management teams.

In this type of market, it’s important to remain patient and vigilant. And while I still favor the long side, staying patient and disciplined is the key to success. Therefore, in this issue I have several trades which are set up to be triggered on strength.

Indexes Test Support

This morning, the major indexes are bouncing back while they test key support. It’s also important to keep in mind that this is a very heavy data week, topped by the Fed’s favorite inflation indicator, the PCE deflator due out on Friday and the initial Q2 GDP, due out on Thursday. There is also plenty of purchasing manager data due out and Existing home sales (Tuesday) and new home sales (Wednesday).

Moreover, given the potential for more political developments, the macro data may have even greater impact on stocks and bonds.

As an aside, I explored the housing situation in my neck of the woods, and I saw an increase in both For Sale and SOLD signs. That suggests that, as I’ve been saying, the decline in mortgage rates is starting to have a positive effect on the market.

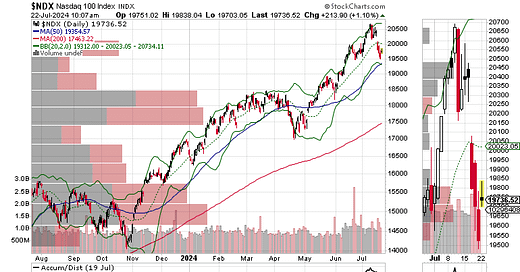

The Nasdaq 100 (NDX), which is heavily weighted in large cap tech stocks, has broken below its 20-day moving average but is holding above its 50-day MA.

The S&P 500 (SPX) is testing its 20-day MA, but has held above 5500, which is the key level above the 50-day MA. A move below 5500 will likely lead to a test of the 50-day.

The market’s breadth, as in the New York Stock Exchange Advance Decline line (NYAD) is holding steady after making new highs. This is of some comfort, but does not guarantee that there won’t be trouble at any time.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.