Bond Yields Break Above 4.4%. Things Are About to Get Interesting.

Fed’s Bostic Signals One Rate Cut in 2024. Powell Speech Straight Ahead.

We may look back at April 3, 2024 as the day in which the Fed threw in the towel on rate cuts.

As the often quoted Ernest Hemingway from “The Sun Also Rises” quote goes, things happen slowly at first and then suddenly. So does the bond market.

This morning’s events had that dominoes are falling feeling. First, the ADP private payrolls number came in well above expected, with 184,000 private jobs created versus an expected 148,000. Inside the report, however, was the data that made bond traders jittery – wages rose at 5.1% year over year.

In addition, a little reported quote from Atlanta Fed President Bostic, issued a week ago, suggests that the Fed is now pondering perhaps just one interest rate cut this year, instead of the three that are being bandied about by the media. Mr. Bostic repeated his expectations on CNBC this morning. All of which sets up Fed Chair Powell’s speech later this morning as a pivotal event, especially ahead of this Friday’s payroll number.

Powell has recently signaled that he likes the way inflation is shaping up. On the other hand, his most recent remarks on the subject came before the eye opening wage gains registered in the ADP report.

Certainly, there are plenty of anecdotal reports on the jobs market to keep in mind. Specifically, the shifting sands in the fast food industry in California where jobs are being cut in order to compensate for new minimum wage laws in the sector, as well as Amazon’s (AMZN) just reported hundreds of layoffs in its cloud computing division.

Elsewhere this morning’s PMI and ISM data came in softer than expected, which softened the initially negative reaction to the ADP data in the bond market.

The bottom line is that this week’s Non-Farm Payrolls number is likely to be pivotal. Your opinion, based on my most recent poll is overwhelmingly for a strong report. Seventy Five percent voted in support of the number of new jobs being above 200,000.

Bonds Test 4.4% Resistance Area

The bond market’s initial reaction to this morning’s data was as would be expected with the U.S. Ten Year Note yield (TNX) moving above the important 4.4% yield. However, the softer than expected PMI and ISM data slowed down the selling and yields moved back below the key yield, as traders await Powell’s remarks.

Still, the bond market is not out of the woods, as price pressures continue to register in all the data released this morning. Contributors are commodity prices, especially oil, and wage pressures.

TNX is trading above its 50 and 200-day moving average. And any negative surprise is likely to send yields moving decisively higher.

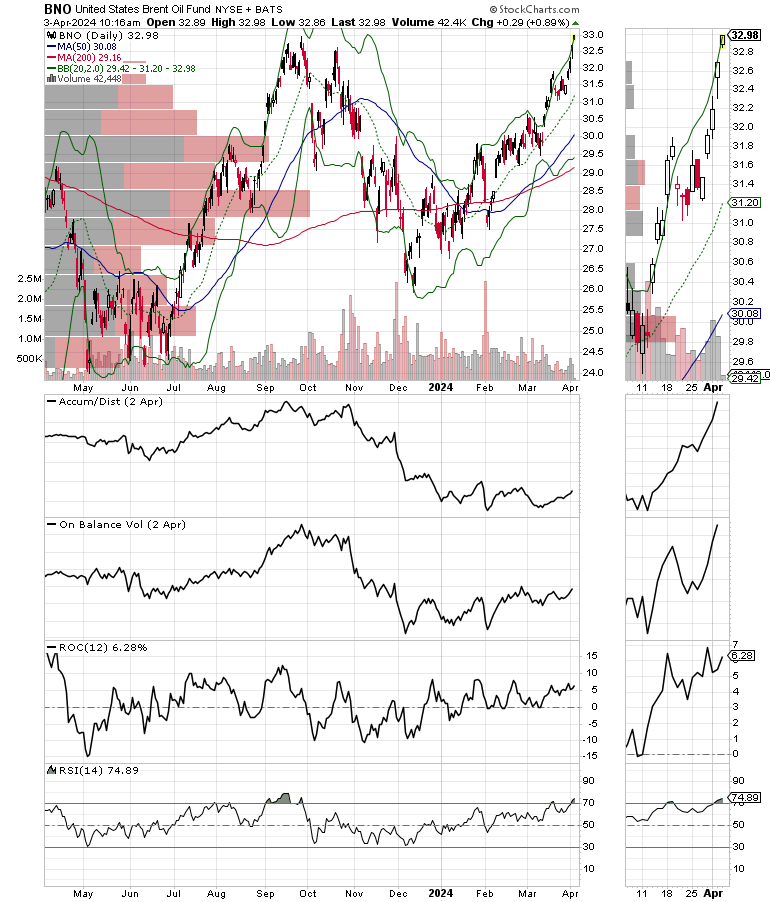

Oil prices continue to climb as the situation in the Middle East continues to boil after Israel’s recent attack of Iran’s embassy in Syria. The United States Brent Oil Fund (BNO) continues to power higher. I’ve been bullish on oil for several weeks and have several oil related picks in the subscriber section of this Substack (click the subscribe button for access) as well as Joe Duarte in the Money Options.com.

The $&P 500 (SPX) held at the support of its 20-day moving average as traders await further developments. The rising ADI line shows that short sellers are covering positions after Tuesday’s decline.

Bottom Line

The sands are shifting in the bond market and this Friday’s Non-Farm payrolls data, preceded by Fed Chairman Powell’s 4/4/2024 speech will likely be major influences.

Thanks to everyone for your ongoing support. I really appreciate it.

If you’d like to support my work further consider a Free Two-Week Trial to Joe Duarte in the Money Options.com.

Thanks also to all Buy Me a Coffee members.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.