Bond Yields Bet on Tame CPI. Plus, a New Trade Featuring a Stealthy Homebuilder.

Under the radar stock looks ripe for a breakout.

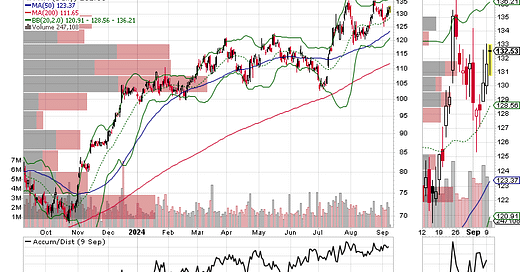

The U.S. Ten Year Note yield is hovering near its low for the current cycle, which started way back in October 2023 and was reaffirmed in May 2024. As I write, this morning’s reading is below 3.7%. As a result, mortgage rates have moved decidedly lower and are also hovering near their recent lows. Certainly, a lot could change with tomorrow’s CPI, on which you can cast your vote here.

I’ve been bullish on the homebuilders for quite a long time. Of late, there have been some changes in the housing market, which are economically related. I’ve chronicled them here and here.

The short version is that as the economy has slowed and consumers have tightened their wallets, homebuilders have faced competition from residential REITs which own apartment complexes and have offered incentives to potential tenants such as rents which are lower than mortgage payments as well as other discounts and amenities.

Homebuilders have adjusted their own approach by focusing on higher quality potential buyers as well as offering their own incentives. Moreover, the large, and deep pocketed, publicly traded homebuilders have maintained their profit margins by containing costs. Thus, even in the face of slower sallies, revenues have grown and profits remain attractive.

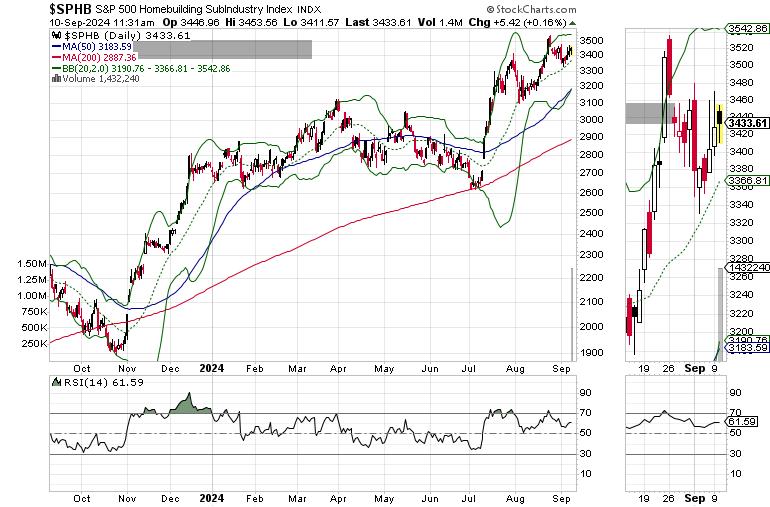

The result has been a bullish consolidation pattern in the S&P 500 Homebuilding Subindustry Index (SPHB), which is closing in on a potential breakout. As a result, I’ve spotted a homebuilder with a very attractive price chart which is flying under the radar. In addition, I’ve also updated sell stops on our current open positions.

Check below for full details.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.