Big Mo is Back! Take $2400 (20%) Profit on AMD. NYAD, SPX, Makes Another New High. Ten Year Note Below 4.3%.

Stay Alert. Trade what you see. Trust the charts not the noise.

Image courtesy of storyblocks.com

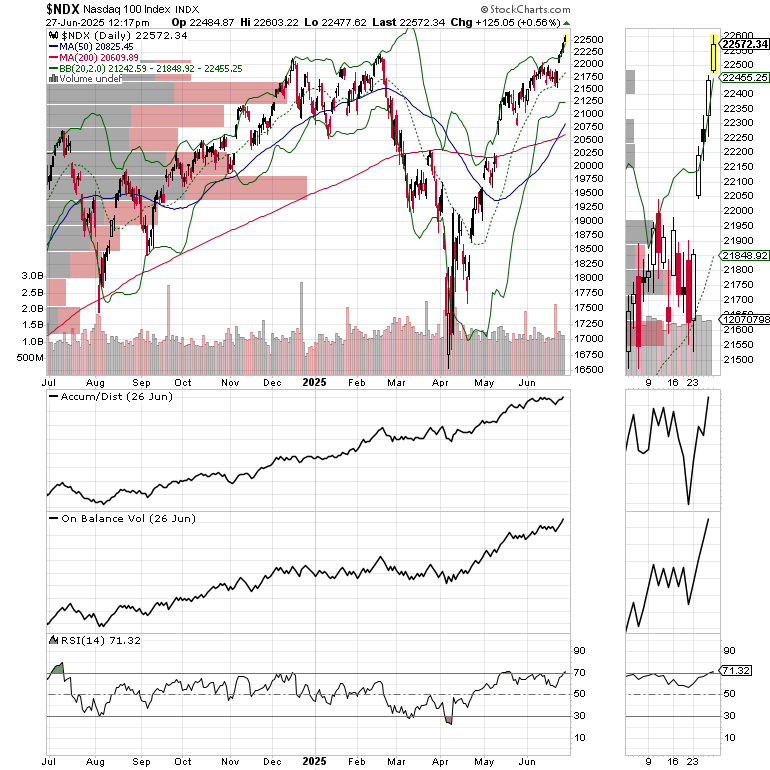

Big Mo is Back. The stock market rally is expanding with New York Stock Exchange Advance Decline line (NYAD), the S&P 500(SPX), the Nasdaq 100 (NDX) making new highs and the U.S. Ten Year Note (TNX) breaking below 4.3% as all signs point to the market betting on a rate cut in July.

The fact is that things are heating up and that at some point, like with all momentum runs, things will quiet down. But not quite yet. At the same time, it makes sense to lock in profits when they appear, so I’m closing out our recent AMD trade with a massive $2400 (20%) profit.

SOLD Advanced Micro Devices (AMD). Bought 6/9/25: $119.75. SOLD 6/27/25 intraday price: $143.74. Return for this trade: $2399/100 shares (20%).

In this issue, I am also updating prices and Sell stops on all open positions.

Big Mo is Back. Don’t Fight the Tape. But Keep Your Eyes Open.

The market is definitely betting on a rate cut by the Fed in July especially after the PCE number came in within expectations and there are at least 2-3 dissenters at the FOMC, Waller, Bowman, and possibly Goolsby. Others may be quietly dissenting.

Thus as I noted this weekend, the market seems to be discounting Powell’s hawkishness and starting to price in a rise in liquidity via rate cuts since.

We are well positioned at both the Weekender and the Smart Money Portfolios. You can gain full access by hitting the subscribe button below.

Market Update – NYAD Blasts to New High

The New York Stock Exchange Advance Decline line (NYAD) is no longer playing around, blasting to a new high which is signaling that money is now pouring into stocks.

The Nasdaq 100 (NDX) made a new high with the 20-day moving average providing support in the short term.

The S&P 500 (SPX) held above 6000 and is now well above 6100. 5950-6000 is now support as is the 20-day moving average.

The U.S. Ten Year Note yield (TNX) is trading below 4.3% and its 200-day moving average, signaling that bond traders are not worried about inflation currently.

Thank you all for your support. If you have a 401(k) plan that offers ETFs as investing vehicles, consider Joe Duarte’s Sector Selector. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here. If you’ve been thinking about tuning up your investment playbook, my new book “The Everything Guide to Investing in Your 20s & 30s” will get you started on the right foot – pre-order now. For those wishing to get started on day trading, consider “Day Trading 101.” For steady gainers, check out the Smart Money Weekender Portfolio. I’ve just added several new positions in this weekend’s edition. Trade better with extra energy, and vitality. Visit my Health Products Page.

Keep reading with a 7-day free trial

Subscribe to Joe Duarte's Smart Money Passport to keep reading this post and get 7 days of free access to the full post archives.